If you have money, chances are you have questions about how to use it. We tackle some common questions to help kids learn about money and how to make, spend and save it.

How do you use money?

You can learn a lot about how to use money. Let’s start with the basics.

Making money

Unfortunately, money doesn’t grow on trees. You can get money by working for it or receiving it as a gift. You don’t have to be old enough to have a job to earn money. You can earn money by doing things that you’re good at or that you like. You could even start a business mowing lawns or selling something you make.

Mya Beaudry, a young person from the Kitigan Zibi Anishinabeg First Nation, created her own business making and selling scrunchies.

What could you do to earn money?

- If you like animals, you could start a business walking dogs or pet sitting for your neighbours.

- If you like being outdoors, consider raking leaves, shovelling snow or cutting grass.

- If you like younger kids, you could babysit or tutor.

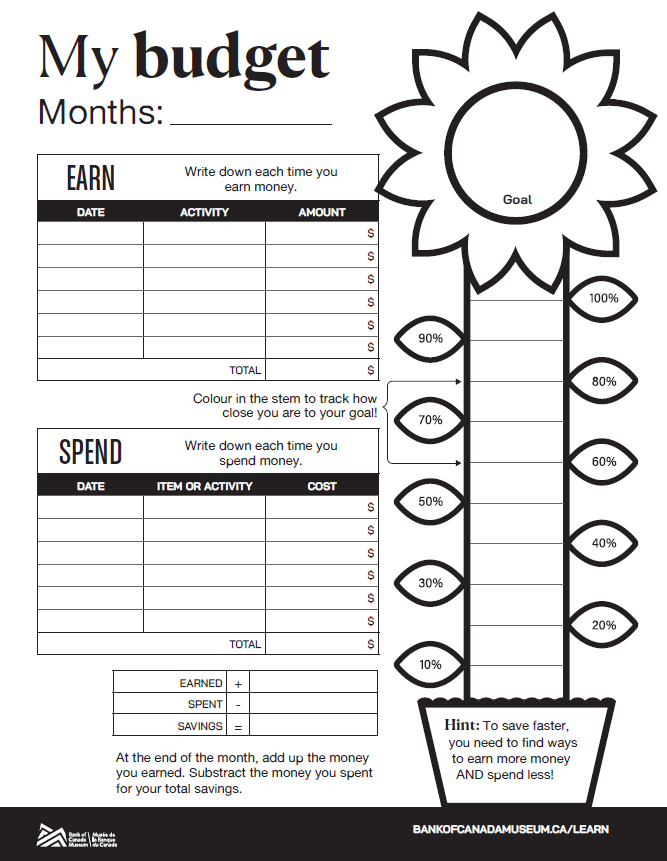

Budgets

But what do you do with money once you have it? That’s for you to decide. A budget can really help. It will allow you to keep track of what you earn (income) and what you spend (expenses). It can also show you how to start saving. Not sure where to start? Try out our budget tool for kids!

Here are some guidelines for making a budget that works:

- Always spend less than you earn. This way, you can save for the future and have money available if something unexpected comes up.

- Practice the 50/30/20 rule.

- 50% of what you earn should go to paying for things you need, like food or transportation.

- 30% should go to things that you want, like video games or concert tickets.

- 20% should go to your savings or to pay back money you owe.

- Consider how you can lower your expenses. Are you paying too much for something? Are you paying for something you don’t need? Ask these questions about the things you pay for every month.

Financial goals

What do you want to save for? It’s important to have short- and long-term financial goals and work toward them. A short-term goal is something that will happen soon, like going to the movies next week or buying a present for your mom’s birthday next month. A long-term goal is something that will happen later, like purchasing a new bike in two years or continuing your education after high school. Our Growing your savings activity can help you set savings goals, make a plan to reach them and track your progress.

Why do we have bank accounts? How do you open a bank account?

Keeping your money in a bank account is a good idea, for a couple of reasons. First, to keep it safe. Money in a bank account can’t be lost, stolen or destroyed. Second, to earn interest. Banks can pay you money for keeping your money with them in a savings account.

To open a bank account, you need to contact a bank by going on their website or visiting a branch. Banks offer different types of accounts, and their employees will help you decide which one is right for you. A savings account will usually have higher interest rates and is meant to be a place where you keep money for longer so that your savings can grow. A chequing account is used for everday purchases with your debit card. At many banks, you can even open a junior or youth bank account with the help of your legal guardian. To compare bank accounts, check out this tool from the Financial Consumer Agency of Canada.

How do you make your money grow?

When you put your money in a bank account—especially a savings account—your bank will pay interest on your deposit. It’s a percentage of the money you put in. If you put $100 in your savings account and leave it there for 12 months, and if your bank gives you 5% interest, at the end of the year you’ll have $105. This is called compound interest and it’s how your money can grow over time. Then, if you leave that $105 in your savings account, you’re now earning interest on $105 instead of $100. Compound interest makes it possible to grow a small amount of money into a lot of money. If you keep adding to you savings and allow the interest to grow over many years, you might even reach $1 million! Explore the Bank of Canada’s investment calculator and see what it might take to become a millionaire.

Why do banks pay you interest? Banks use some of the money their customers deposit to make loans and investments. Banks pay interest to their customers because those customers are providing the bank with money to do this.

How do credit cards work?

Credit cards can be like borrowed money. When you use a credit card, you are basically taking out a loan from the company that gave you the card—known as the issuer—to pay for something. You can pay this amount back in full every month with no interest, but if you don’t pay it all back every month, you will owe interest—the bad kind of interest. Interest rates on credit cards can be more than 20%, so something that cost $100 would end up costing you $120.

Why do banks charge you interest? Because Banks and credit card companies are businesses and one of the ways they make money is by charging interest. When you use a credit card, you’re making purchases with their money, not your own. If you don’t pay the full amount on your credit card, you will keep paying extra for that borrowed money.

What about debit cards? Debit cards are a way to electronically spend the money that’s in your bank account, much like you do with a credit card. Debit cards can be used to make purchases when you don’t have cash. But they immediately take the money out of your bank account. That way you can’t spend more money than you have in your account and you aren’t borrowing from the bank so don’t owe any interest.

What if I have more questions about money?

If you still have questions about money, you can find answers at the resources below.

Have you ever wondered what money actually is? Or what happened to the penny? We thought you might be wondering, so we answered these questions and more in our blog post Understanding Money: Common Questions.

What are taxes? What do taxes pay for? How do I file my taxes? These are good questions, and you can find all these answers and more on the Canada Revenue Agency’s site Learn about your taxes.

How do you plan for my education? How do you buy or rent a home? For these big questions and ideas for all the major financial decisions in your life, visit the Financial Consumer Agency of Canada.

How can you learn more about financial literacy? See our blog Talk to your kids about money for tips and resources for all ages.

The Museum Blog

Love tokens: Change of heart

For centuries, people have been adding alternative messages to coins as political protests, advertising, commemoration and—most charmingly—love and affection. Such things are called love tokens.

Three 50-cent pieces: The big changes to our small change

The maple leaves, beavers, schooners and caribous appear unchanged every year on our regular issued coins. But the 50-cent piece is a different story, because every time our coat of arms has changed, so has the coin.

New acquisitions—2025 edition

From rare toonies to Métis scrip art, the Bank of Canada Museum’s 2025 acquisitions show how money and the economy shape Canadian lives.