Enjoy Financial Literacy Month with us onsite and virtually throughout November. Check out some of our elementary and secondary resources.

Onsite activities

Join us at the Museum throughout the month of November for special activities for the whole family.

- Check out our special exhibition Money in 10 Questions: Kids Edition and learn the basics of money and personal finance – and have fun doing it.

- Craft a paper flowerpot to track your financial goals and decide how to achieve them.

- Weekends only: Practice making financial decisions by buying clothes and accessories in our Avatar market.

Elementary resources

Growing your savings

Help your child learn about setting financial goals. Use a plant diagram to visually track their progress to save up for a special item.

Exploring coins and bank notes

Identify symbols and denominations on coins and bank notes. Our printable worksheets will introduce young learners to Canadian money.

Counting money and making change

Use money for skip counting and begin making change in different ways. Engaging worksheets will introduce elementary students to Canadian money and math.

Representing money in many ways: Addition, fractions and equivalents

Practise adding and making change. Worksheets introduce decimals and fractions using Canadian money.

Exploring payment methods

Compare different payment methods, such as credit, debit and cash. This lesson plan uses a quiz, group work and scenarios to boost financial literacy.

Needs or wants? That is the question!

Determine if something is a want or a need by sorting a stack of cards featuring different expenses. Use this hands-on activity to sharpen decision-making skills and financial literacy.

Understanding Money: Common Questions

Answer your students’ money questions with this comprehensive FAQ. Explore money history, symbolism and more to kickstart a class discussion or money inquiry project.

Printable play money

Practise counting and making change with Canadian money. Print, cut and use our realistic play money to practise saving, spending and recognizing coins and bank notes.

Secondary resources

Investing wisely

Make investment decisions based on what’s important to you and see how your spending and earning connects you to the global economy.

Decoding Canadian economic data

Develop data literacy skills by interpreting charts of Canadian economic data.

Building budgets

Balance a monthly budget for a household and learn some financial saving and spending tips along the way.

Thinking like an economist

Introduce your students to foundational economic concepts using everyday examples.

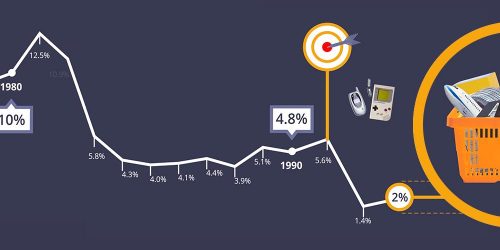

Price check: Inflation in Canada

All about inflation: what it is, what it means and how it's measured. Students will learn how the consumer price index is calculated and create their own student price index to measure the prices that matter most to them.

The economics of suppertime

Prepare a meal while factoring in a balanced budget and a balanced meal. This meal-planning activity is great for building healthy eating and financial habits.