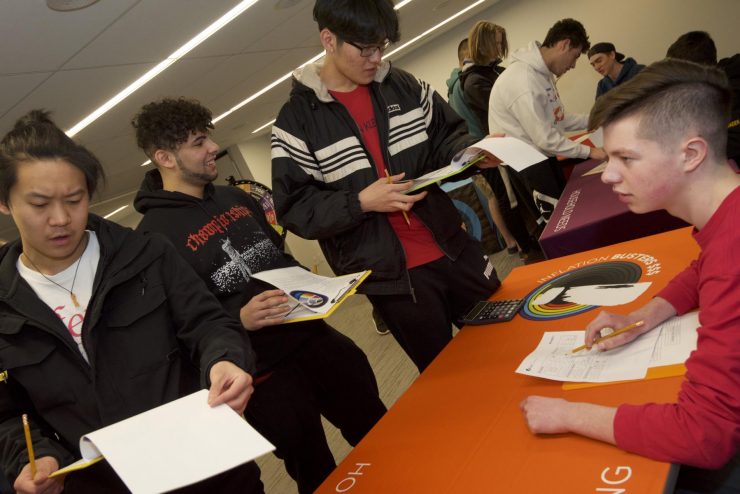

Develop a budget and navigate the economy in a time of high inflation in this game-based program that's offered onsite.

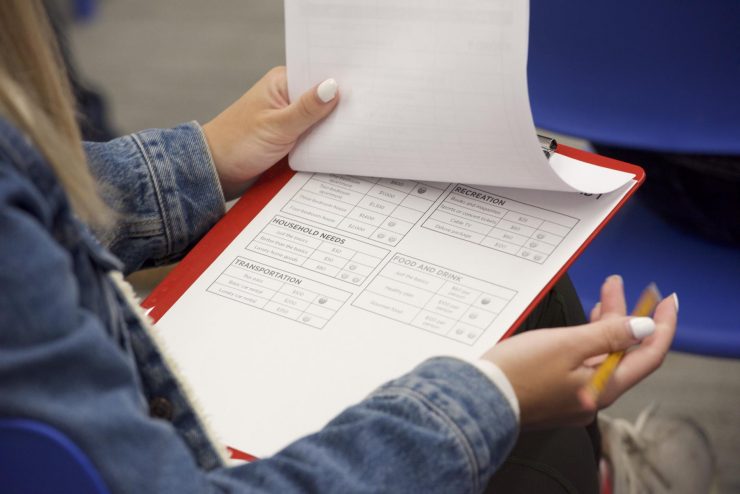

Students will see first-hand how difficult it is to plan when inflation rises. As goods become more expensive, students will look for ways to afford what they need. A great game to build financial skills while learning about the Bank’s critical role in keeping inflation low and stable.

Grades

Grades 9 to 12; Secondary Cycle Two and CEGEP

Big idea

Low and stable inflation allows everyone to plan for the future.

Learning objectives

Students will:

- compare the life of a consumer in times of both high inflation and low, stable inflation

- recognize the role of the Bank of Canada’s monetary policy in the financial choices and lives of consumers

- evaluate the importance of the economy and inflation in their lives

Curriculum links

Ontario

- Economics

- Grade 11: The individual and the economy

- Political and economic systems

- Financial planning

- Government intervention

- Grade 12: Analysing current economic issues

- The role of government in redressing imbalance

- Monetary policy

- Grade 12: Making personal economic choices

- Financial goals and financial planning

- Understanding the canadian economy

- Business Studies

- Grade 9 or 10: Introduction to business

- Economic basics

Quebec

- Secondary V: Financial Education

- Elements in drawing up a budget

- Why consumer habits may change

- Reasons for saving money

- The government and the economy

Duration

This onsite program requires 2 hours. You’re welcome to book a 30-minute self-guided visit following your program.

Availability

This onsite program is offered Thursdays and Fridays. The last booking is at 15:00.

Cost

All school programs are offered free of charge.

Class size

25 to 50 students per program.

Book your visit

or call 613‑782‑8914 to book a visit. Please include the following information in your request:

- date and time of arrival

- number of students and teachers

- program or tour of your choice

- preferred official language

- any accessibility or special needs

We will confirm your booking within five to seven business days.

Before your visit

Try out the following activities:

- Delve deeper into the Consumer Price Index (CPI) and create a personalized CPI with the lesson plan Price Check: Inflation in Canada.

- Have a class discussion on inflation in Canada over time with the video Inflation Over Time.

Changes and cancellations

To ensure the best possible experience for all visitors, we kindly ask groups that make reservations to adhere to the following guidelines:

- Cancellations and changes:

Groups that need to change or cancel reservations for programs must tell us at least 48 hours in advance. Failure to do so may impact your ability to book our programs in the future, including participation in our bursary program. - Late arrivals:

Groups that arrive 15 minutes or more after their scheduled start time may forfeit their reservation. If you anticipate being late, please contact us as soon as possible at 613-782-8914 or . - Minimum group size requirement:

We may cancel your reservation if, upon arrival, your group does not meet the minimum size requirement for the reserved program.