Unlock financial literacy with challenging puzzles in this classroom escape room. Students will explore financial risk, credit scores, debt and interest with worksheets and an interactive game.

Overview

This lesson introduces the concept of borrowing as a strategy to meet financial goals, including when this strategy is used and the benefits and risks. Students learn about the concepts of credit scores and calculating simple interest.

Big idea

Borrowing money is a strategy most people use at some point in their lives to reach their financial goals. Understanding the risks, benefits and costs of borrowing can help you make good decisions about when and how to borrow money.

Total time

60 minutes of instruction and 60 minutes for the escape room activity

Grade levels

Grades 6 to 8

Subject areas

Math

- Addition and multiplication of numbers with decimals

- Conversion of percentages to decimals

- Multiplication of percentages

- Simple interest calculation

- Math problems using money

- Word problems

Financial literacy

- Debt

- The risks and benefits of borrowing and lending

- The cost of borrowing

- Credit scores

Learning objectives

Students will:

- solve math problems by adding and multiplying numbers with decimals and by turning percentages into decimals

- find the percentage that a number represents [out] of a larger number

- calculate simple interest

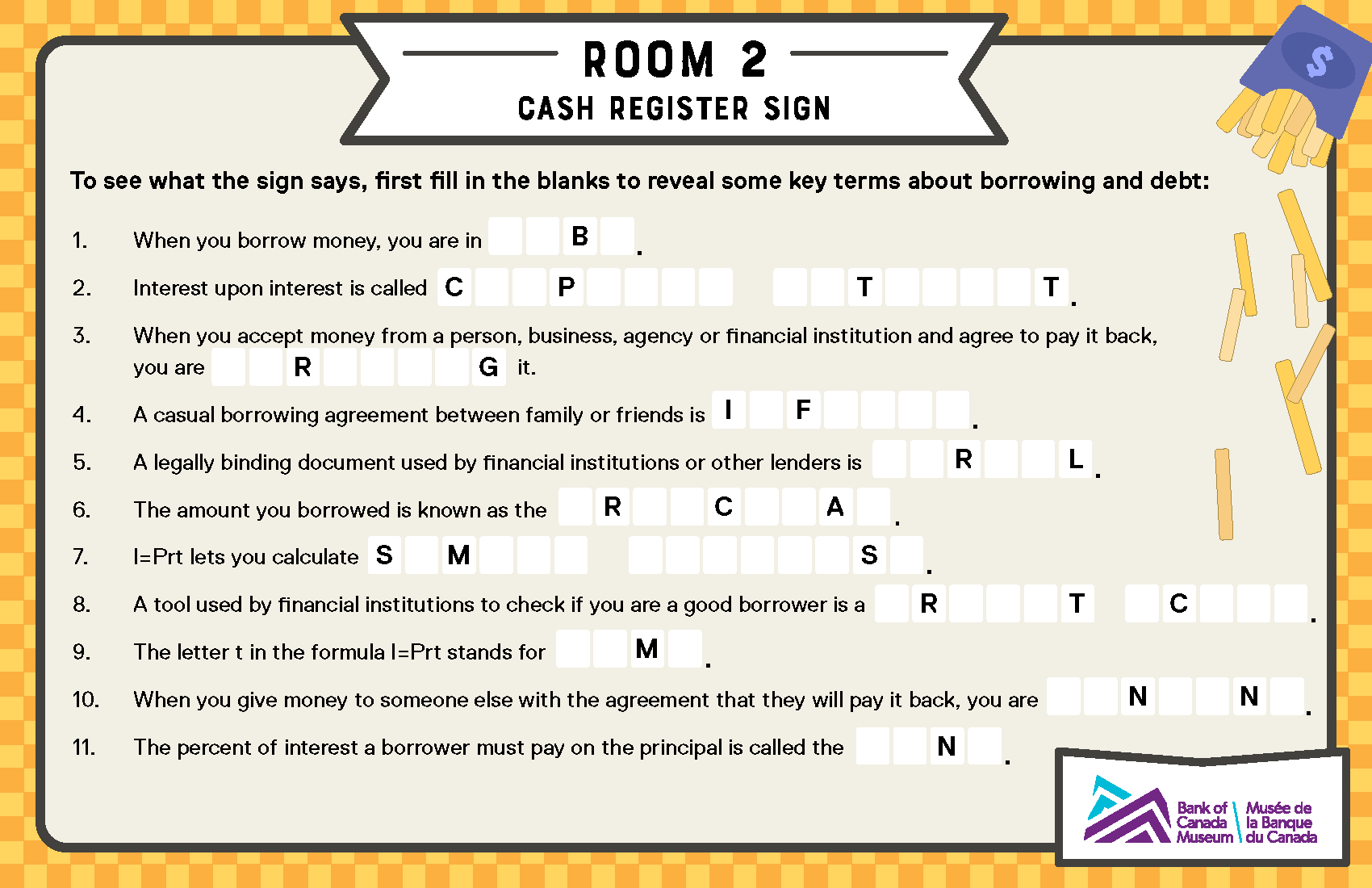

- define key terms related to borrowing and lending

- explain the benefits and risks of lending and borrowing money

- explain the reasons why individuals may use borrowing as a strategy to meet their financial goals

- identify some of the ways the federal government protects consumers

Materials

Classroom supplies and technology

- printer and computer paper

- card stock (optional)

- pens and pencils

- calculators

- projector or display screen hooked up to a computer (optional)

- board, chart paper or screen and markers

- internet-connected devices such as tablets or laptops (optional)

Worksheets

- Download the worksheet package and escape room package.

- Print the resources below in the quantities indicated. To save on paper printing, these resources can be distributed digitally or displayed for the class. All student worksheets are fillable PDFs.

- Activity 2—Simple interest worksheet package consisting of:

- the worksheets “Percentages and decimals” and “Keep it interesting” (one copy of the package per student or pair)

- answer keys (one copy for the class, or share on a screen to correct answers)

- Activity 3—Escape room package consisting of:

- teacher’s script (one copy)

- answer key (one copy)

- puzzle pages for five game activities (one set per group of three to five students, printed on card stock if possible. If possible, print the full page and cut in half horizontally. Glue the pieces back-to-back to make double sided cards.)

- Activity 2—Simple interest worksheet package consisting of:

Activity 1: Borrowing and lending

Students are introduced to borrowing, lending and interest.

Time

30 minutes

1.1 Introduction

Share an anecdote with your students about a real or fictional time that you borrowed or loaned something. For example, talk about when your sister borrowed your new sweater and gave it back with a stain, or the time you loaned your neighbour a serving dish for their party and they returned it full of cookies.

Ask students about some of their experiences with lending and borrowing.

- Have you ever lent something?

- How did it go? How did you feel about it?

- If you lent something to someone and they didn’t return it on time or in the same condition, do you think you would lend to them again?

- Have you ever been the borrower?

- What [reasons/need] did you have for borrowing something?

- Have you been a responsible borrower?

- Did you do anything to [say thank you/show gratitude] to the lender?

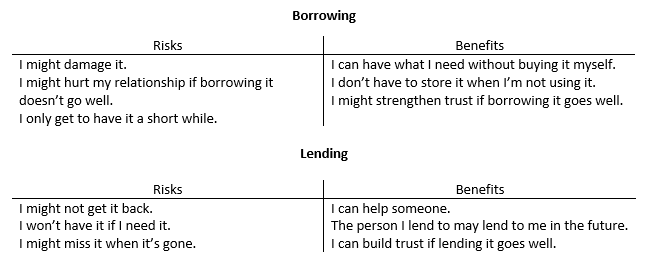

Lending and borrowing have benefits, but they also have risks. On a board, chart paper or screen, create two t-charts, one for borrowing and one for lending. Label the sides of each t-chart “Risks” and “Benefits.” Ask the class to list some of the risks and benefits of borrowing something and note their answers on the “Borrowing” chart. Then repeat with the “Lending” chart.

Examples:

1.2 Borrowing money

Ask students:

- If you wanted to buy something and you didn’t have enough money, what would you do?

- Have you ever borrowed money from your family, with the promise of paying them back when you had enough money to do so?

- What would happen if you couldn’t pay them back?

- Have you ever lent money to someone?

- If the person you lent money to didn’t pay you back or paid you back really late, would you lend them money again?

Just like they borrow things, most people (as well as businesses and countries) will borrow money at some point. Borrowing money is always a risk, but it is also one strategy people can use to meet their financial goals. Financial goals are the objectives we each set for managing our money.

Brainstorm with the class some of the reasons people may [borrow money/use a borrowing strategy] to meet their financial goals. You can use these examples to get the conversation started:

- to pay for large purchases they’d like to use right away, such as a fridge, a car or a house

- to cover unexpected expenses, e.g., to repair damage after a storm or if their bike breaks

- to pay for [daily needs/groceries and housing] if they don't have a job for a while (unemployed), or they are earning less than they need to [live/cover living expenses] (underemployed), or they can't work as much as they usually do.

- to buy something expensive that they haven’t saved for, such as a trip, renovation or post-secondary education

Next, brainstorm a list of sources and tools people can use to borrow money.

Examples:

- family or friends

- banks and financial institutions (e.g., for mortgages, loans and credit cards)

- government agencies (e.g., for student loans)

- private companies (e.g., for payday loans or cash advances)

- legitimate, federally regulated financial institutions (e.g., banks and credit unions) at the Office of the Superintendent of Financial Institutions

- licenced payday loan companies on Innovation, Science and Economic Development Canada’s Consumer Hub

Explain to students that there are two ways to borrow money: loans and credit.

A loan is a lump sum of money given all at once (usually for something specific, such as to buy a car or pay for university) with a set repayment schedule. Typically, the borrower agrees to repay a loan with a set amount every month.

For example: Stacey wants to buy a new TV. Her dad will loan her the $500 she needs to buy it. Stacey agrees to pay back the loan at $50 a month for 10 months.

Credit is an agreement to provide money up to a set maximum amount that will be paid back over time. The borrower can use as much or as little of the maximum amount as they wish at any time, and they must make minimum payments every month. To save money, the best approach is to pay off the total amount borrowed every month when it’s due. Credit cards are the most common credit tools.

For example: Stacey’s dad will give Stacey up to $1,000 for anything she needs or wants, but she must pay it back when she can, and she must pay back at least $10 every month. Stacey will use $500 from her credit with her dad to buy the TV. She will need to be careful to pay back as much as she can each month.

Explain that lenders expect their money to be returned. The money that people borrow and must pay back is known as debt.

Most loans and credit agreements require a borrower to pay interest on the money they borrow. Tell students they will look at interest more closely in Activity 2.

Review your initial t-charts of the risks and benefits of lending and borrowing. Ask the students how these might be similar or different for lending and borrowing money. Using a different colour board or chart marker, circle anything from your first list that applies to money and add these to new t-charts for borrowing and lending money. Continue to fill in the charts with more examples of risks and benefits specific to money. Keep these charts posted somewhere accessible and add to them throughout the lesson if new ideas come up.

1.3 Reducing risk

Explain to students that both borrowers and lenders want to reduce the risk as much as they can. Discuss some of the main tools used to reduce risk: borrowing agreements, credit scores and interest. Write each of these terms on the board and add key points as you discuss them.

Borrowing agreement

When we borrow money, we are expected to pay it back. We have an agreement that outlines the rules for being a good borrower and lender, which helps reduce the risk the loan might go wrong. It may be an informal agreement, such as when a person borrows money from a friend and agrees to pay them back tomorrow, or a formal agreement that is a detailed legal document used by businesses, financial institutions and lending agencies. These agencies must follow government regulations.

Credit score

Lenders want to work with people who are going to be good borrowers—those who are likely to pay them back. Family and friends might do this in informal ways, such as thinking about how much they trust the borrower or whether that person had repaid them last time. Formal lenders, like financial institutions, businesses or agencies use a tool called a credit score. This is a rating an institution uses to determine if someone might be a good borrower, which helps protect that institution from risk. A person’s credit score is based on what they’ve borrowed in the past. If their credit score is too low, they may have difficulty getting approved for a loan, or borrowing money may be more expensive than it would be for someone with a higher credit score.

Interest

Lenders may choose to use a tool called interest to protect themselves from risk. Interest is a fee a borrower pays for the privilege of borrowing. When borrowers take out a loan to buy something, they will pay more for it than if they had bought it with money they already had. Interest is also used to encourage borrowers to repay their loan or make their scheduled payments on time. Over time, interest grows, which is a way that businesses can [earn more money from/increase their profit on] the money they loan. Individuals can earn interest too. When they put money in their bank account, the bank will pay them interest as a reward for letting the bank use their money.

Activity 2: Calculating interest

Students will learn the steps to calculate interest.

Time

30 minutes

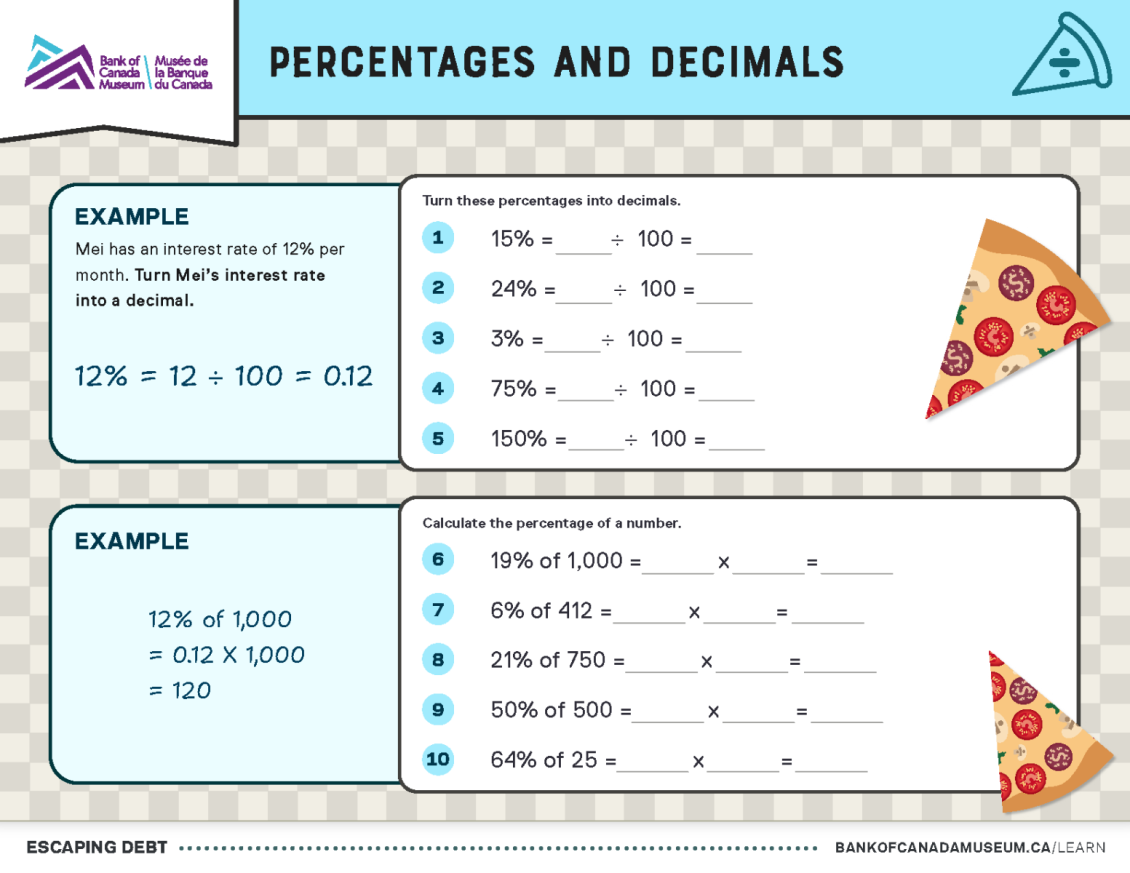

2.1 Worksheet activity: Percentages and decimals

Hand out one copy of the simple interest worksheet package to each student. Or ask them to form pairs, and give each pair a copy. Tell students they will be working with the “Percentages and decimals” worksheet first.

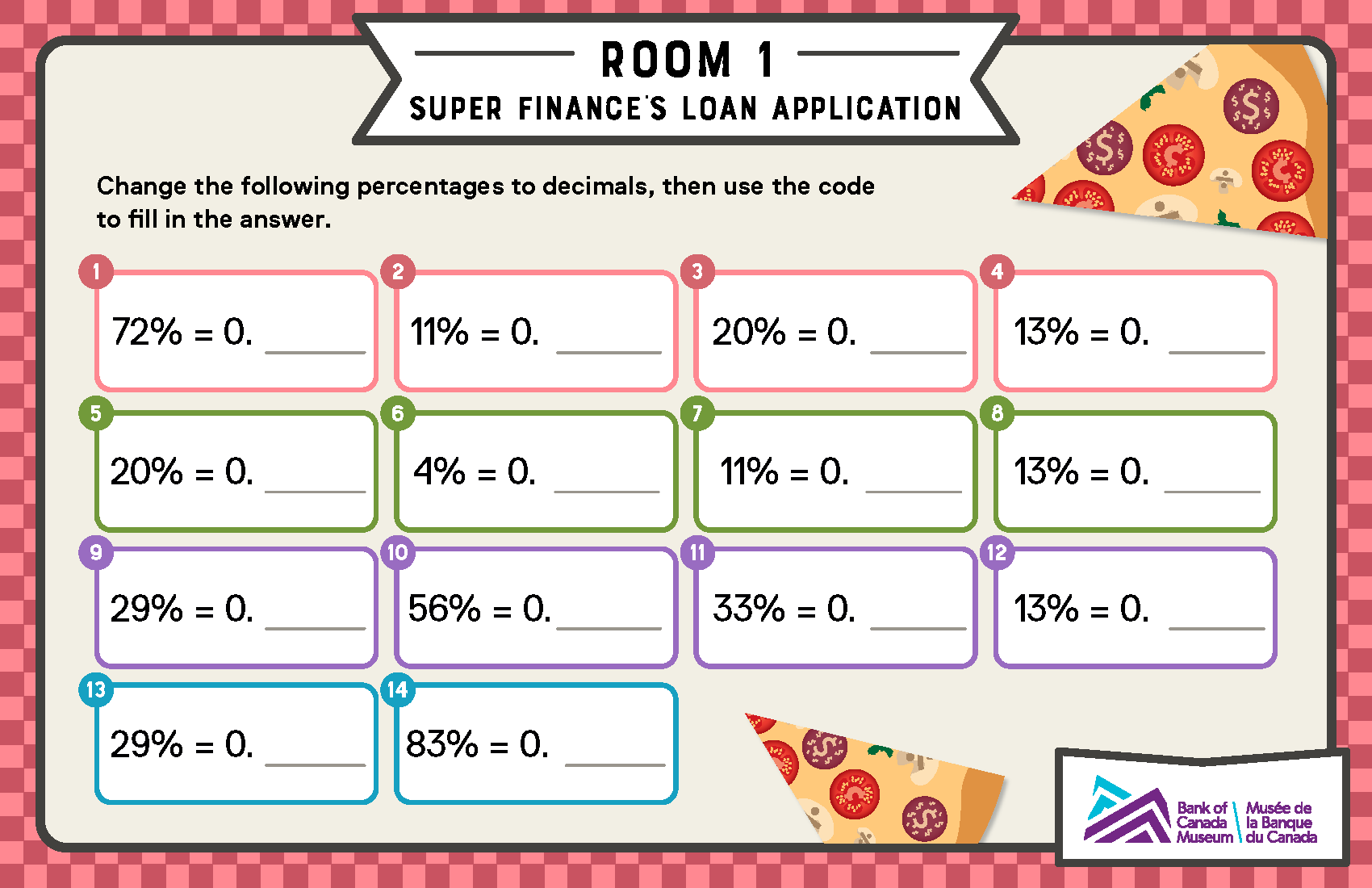

Explain to students that we express interest rates as percentages. To work with percentages, we must first change them into decimals. Show students how to convert a percentage into a decimal, either using division or by moving the decimal point.

Do the example question on the worksheet together. Then have the students or pairs answer questions 1 to 5 to review and practise turning percentages into decimals. Review the answers together or use the answer key to correct their work.

For questions 6 to 10, students will need to be able to find the percentage of a number to calculate interest. Show them how to calculate the percentage of a number by converting a math sentence into an equation or by multiplying the decimal form of the percentage by the number.

Do the example question together. Then have the students or pairs answer questions 6 to 10 on the worksheet to review and practise finding the percentage of a number. Review the answers together, or use the answer key to correct their work.

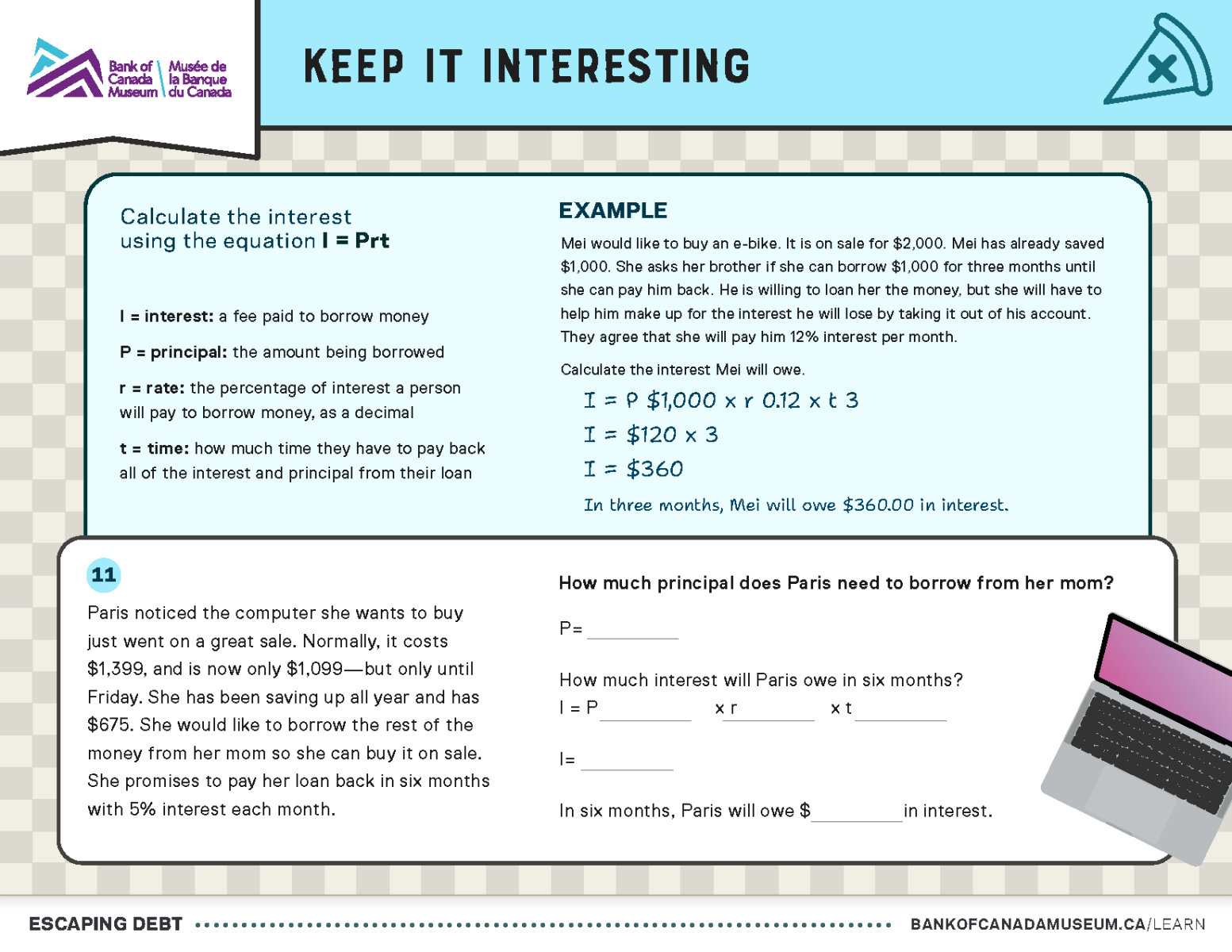

2.2 Worksheet activity: Keep it interesting

Explain to your students that there are two main types of interest: simple and compound.

Simple interest is the fee a person will have to pay on the amount of money they borrowed, which is known as the principal. Simple interest is based on the interest rate they agreed to borrow at and how long they will have the loan (time).

Compound interest is calculated for periods of a loan (e.g., daily or monthly). In each period, a person will pay not only the interest on the principal, but also interest on the interest they owe from the previous periods. Financial institutions and formal lenders often use this type of interest.

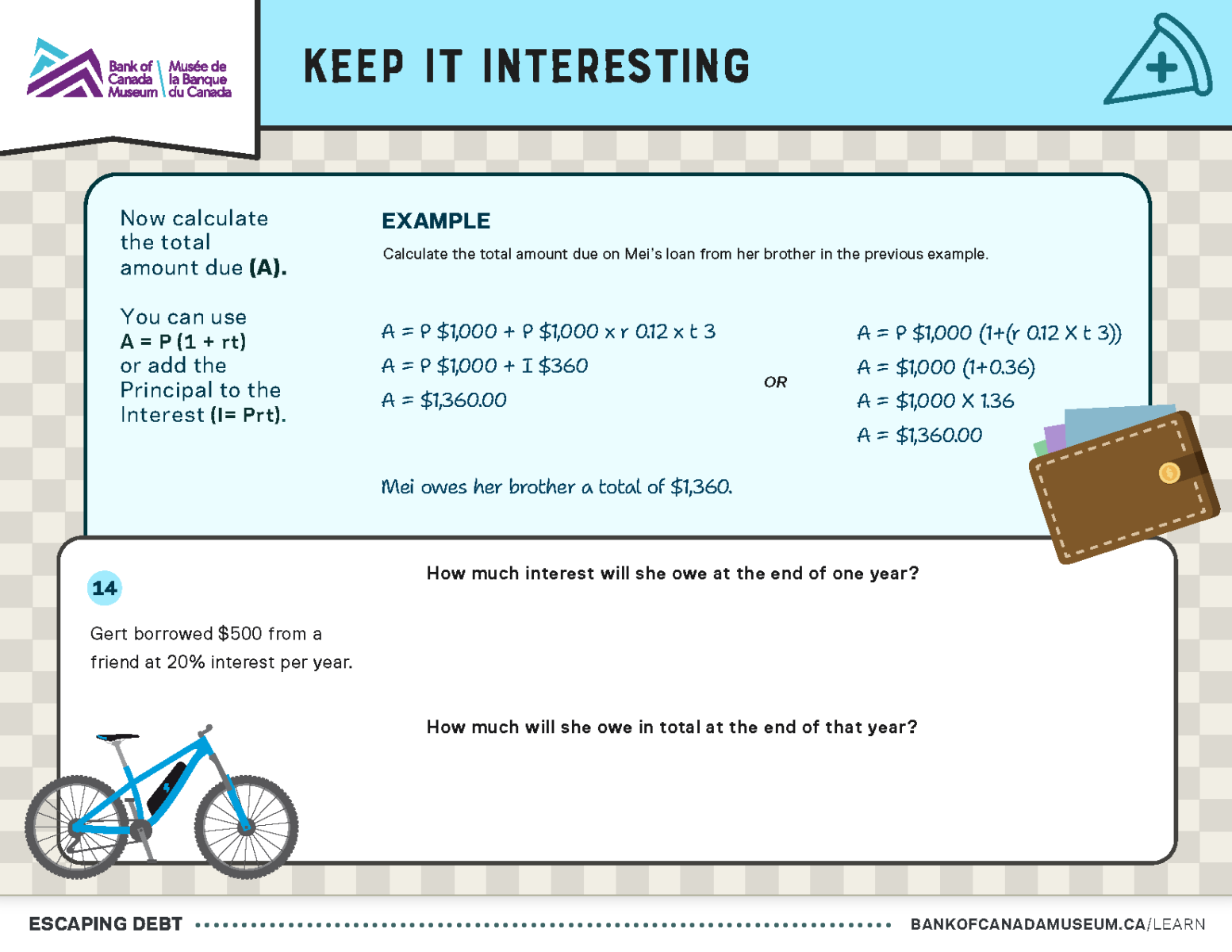

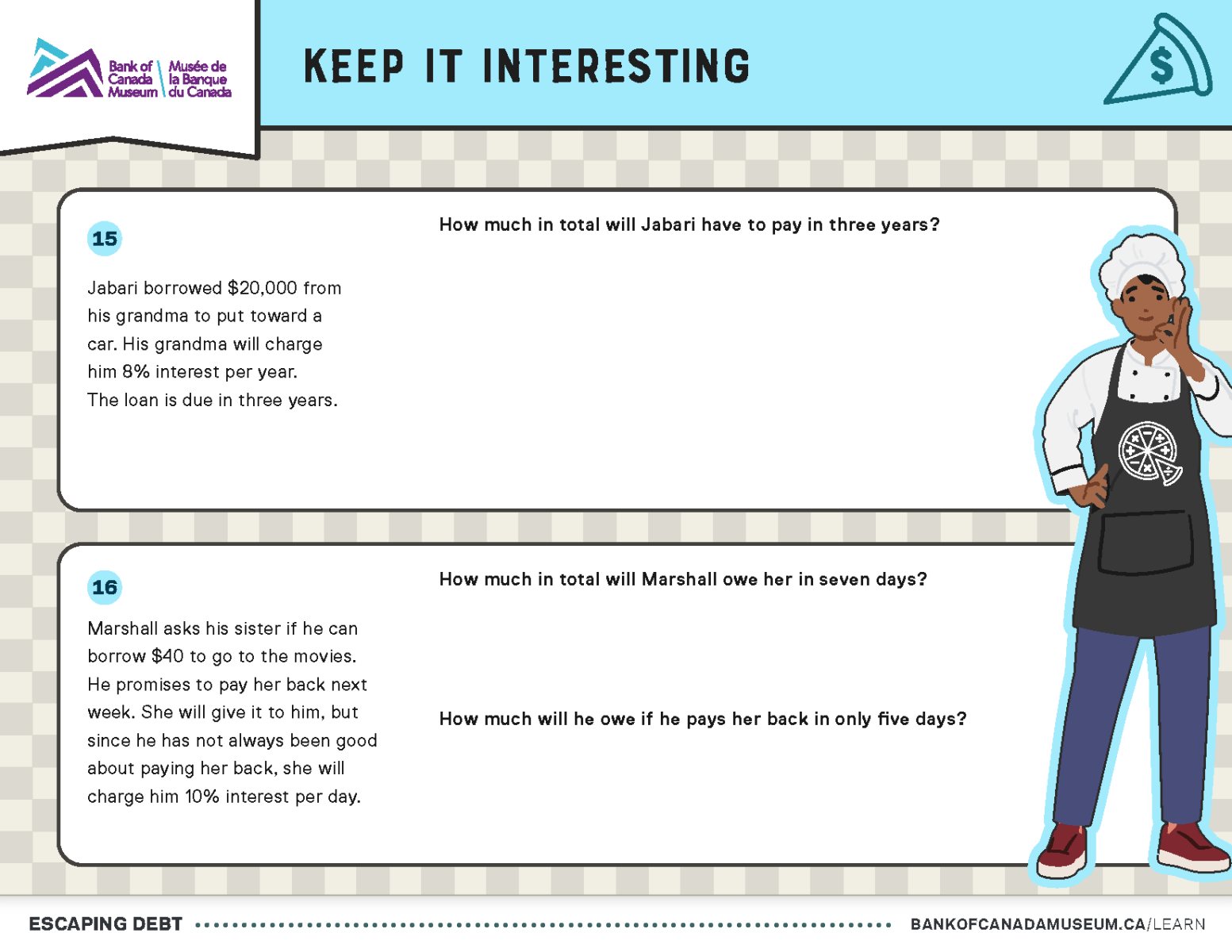

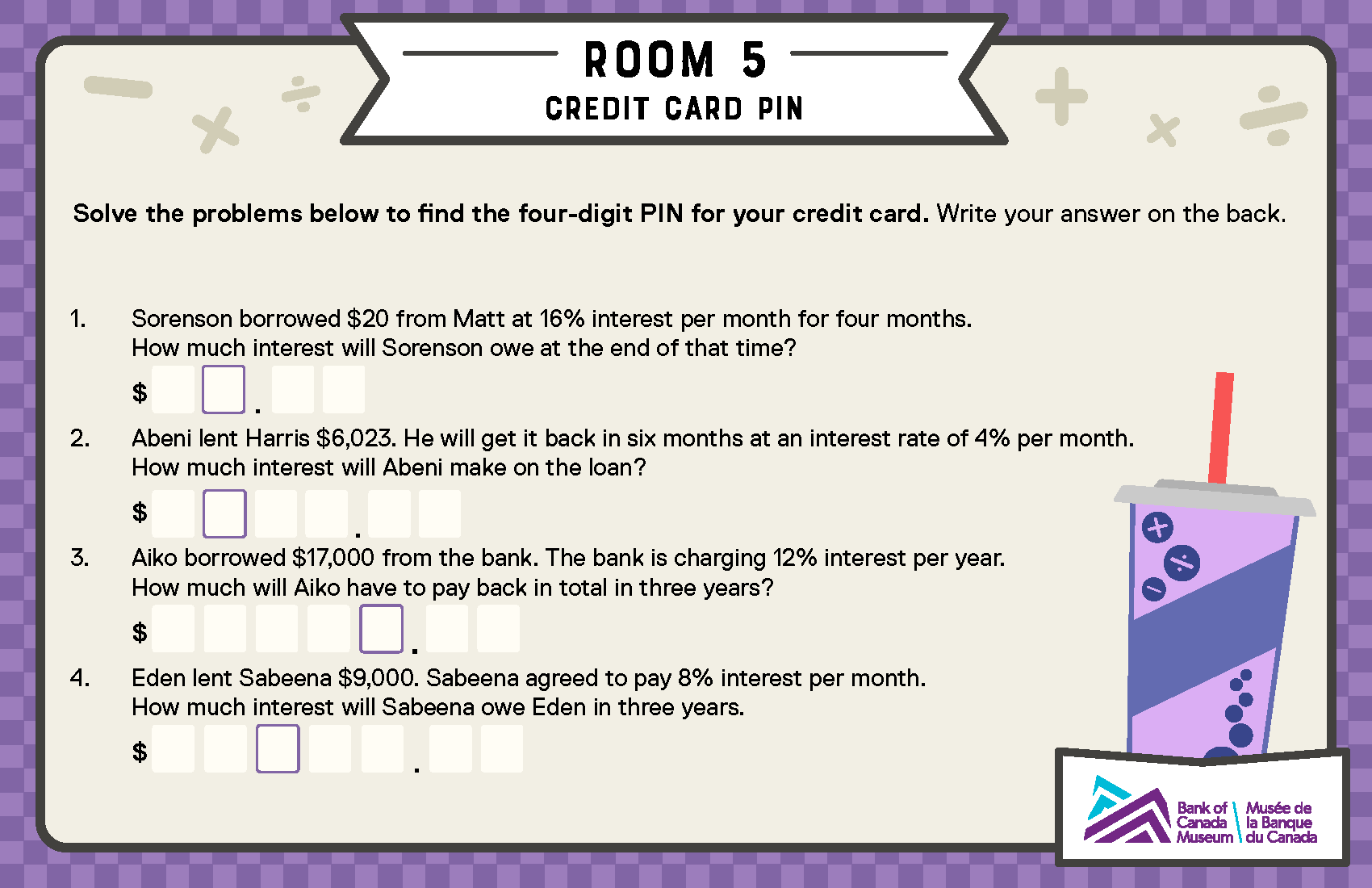

Word problems will help students understand calculating interest using the equation I = Prt.

Tell students that, for the second worksheet in the package, “Keep it interesting,” they will calculate only simple interest. Explain the formula for simple interest: I=Prt.

- I = interest: a fee paid to borrow money

- P = principal: the amount being borrowed

- r = rate: the percentage of interest a person will pay to borrow the money

- t = time: the length of time they have to pay back all of the interest and principal from their loan

Explain each term using the graphic at the top of the worksheet. You can show this on a screen or board, or have students follow along on their own sheets. Make sure that students understand these terms for the next activity.

Remind students that the units for the time must match the units for the rate. If the rate is in months (e.g., 12% per month) and the time is in years (e.g., 4 years), they will need to multiply the time unit to convert it to months as well. In this example, 4 X 12 = 48 months.

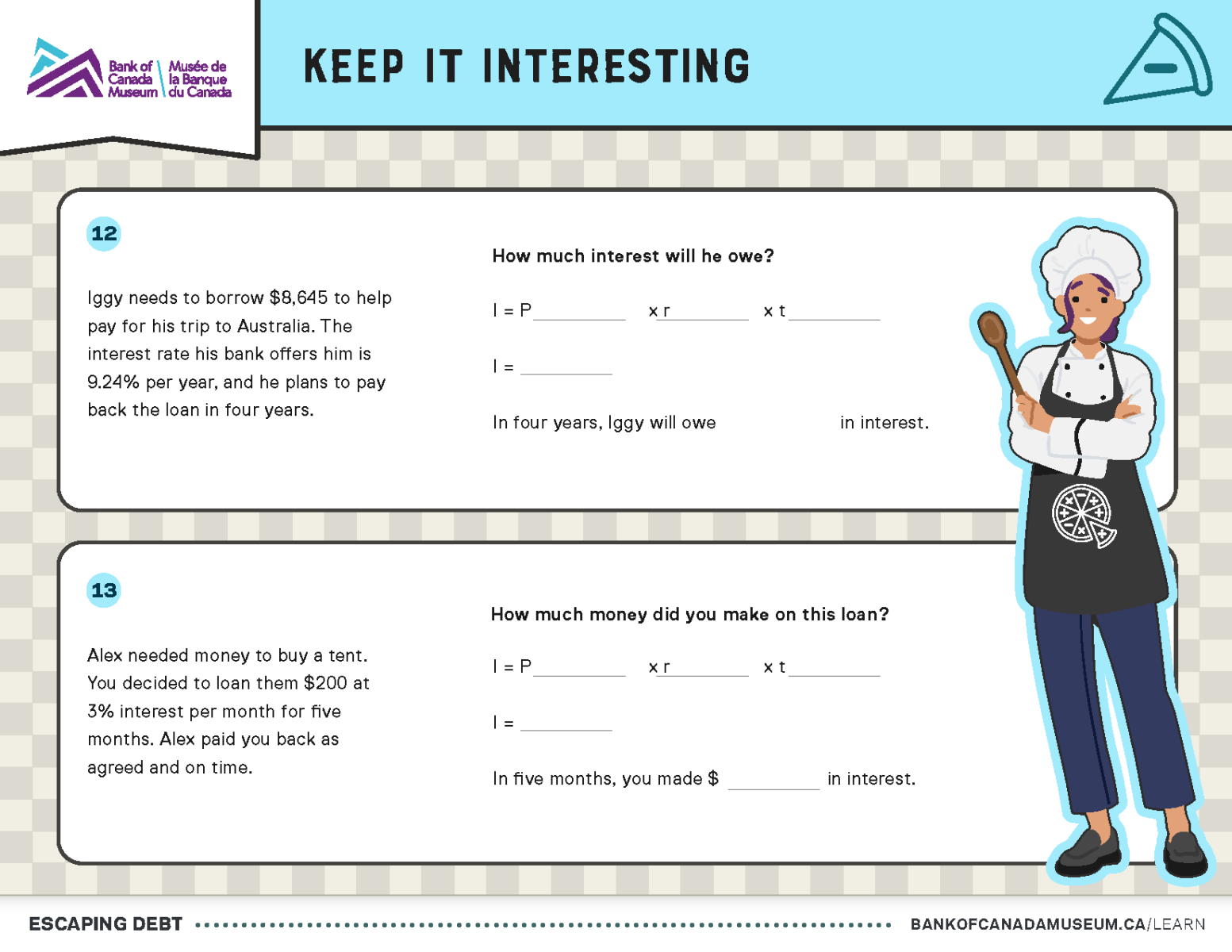

Do the example question on the worksheet together. Then have students or pairs answer questions 11 to 13 to review and practise finding the interest or principal on a loan. Review the answers together, or use the answer key to correct their work.

Next, explain to students that there are two ways to calculate the total cost of borrowing money, depending on what works best for them. They can add the principal (P) to the interest (I=Prt) or use the formula A=P(1+rt), where A is the total amount due. If needed, demonstrate the second approach on the board. Remind students to use order of operations.

Together, do the next example question on the worksheet. Then have the students or pairs answer questions 14 to 16 to review and practise finding the total amount due. Review the answers together, or use the answer key to correct their work.

Activity 3: Escaping debt

Students will solve an escape room with five puzzles.

Time

60 minutes

3.1 Escape room activity

Divide the class into small groups of three to five students. Use the “Escape room package” to lead students through each of the five puzzles in this activity:

- Room 1: Super Finance’s loan application

- Room 2: Cash register sign

- Room 3: Payment tools

- Room 4: Restaurant map

- Room 5: Credit card PIN

One room at a time, read the teacher script and give each group the puzzle for that room. Make sure all groups have completed each puzzle before going on to the next. The answer key will give you the answers to each puzzle. Review the puzzles in advance so you can provide hints or assistance to students, as needed.

When all 5 puzzles have been completed, the students have escaped! Follow the script for the conclusion to the activity.

Students will have to solve all five puzzles to pay their restaurant bill and “escape”.

Conclusion

Time

5 minutes

Wrap up the lesson with a discussion. Borrowing money can seem overwhelming, but in Canada, many government agencies and institutions are responsible for the safety and wellbeing of the financial system and the people who use it. Share three of these institutions with the students, by writing the names on the board or showing their websites on a screen.

- Bank of Canada: One of the Bank’s core functions is to oversee Canada’s financial system. A stable and efficient system is essential for the economy to keep growing and Canadians’ living standards to keep rising. By supporting this system, the Bank helps build and protect our economic and financial welfare.

- Financial Consumer Agency of Canada: The FCAC [protects/helps protect] the rights and interests of consumers when they buy financial products and services. It supervises financial institutions that must follow federal government rules, such as [private/commercial?] banks. The FCAC also helps Canadians [{build/improve} their financial literacy/learn how to make informed decisions about their money].

- Office of the Superintendent of Financial Institutions: OSFI supervises and regulates financial institutions such as banks, insurers, and trust and loan companies as well as private pension plans that must follow federal government rules. This supervision helps build Canadians’ confidence in the financial system.

Key takeaways

- Borrowing money is a common strategy people use to meet their financial goals.

- Lending and borrowing have both risks and benefits.

- A loan may include interest, which will increase the amount that the borrower must pay back.

Extensions

- Explore the flip side of debt using the Bank of Canada Museum’s lesson “Saving for the Future: planning for goals”.

- Explore how personal financial decisions and the broader economy connect in the Bank of Canada Museum’s lesson “Thinking like an economist”.

- Have students read the Bank of Canada’s article, “Household differences and why they matter”. Create a diagram to illustrate the relationships and impacts between the economy, households and monetary policy.

- Ask a local bank for a copy of their small loans or mortgage agreements and have students examine actual borrowing agreements. Review the National Student Loans Service Centre website to see a copy of the Master Student Financial Assistance Agreement for your province or territory.

- Review the FCAC’s information on credit scores. Ask students to make a plan for how they will get the best credit score you can as you get older.

- In some religious practices, charging interest is not permitted. Invite students to research their own religious teachings on interest and debt, or learn more about the practice of others. What are some ways—such as halal mortgages—that financial institutions are reducing their risk while meeting the religious needs of clients?

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.