Develop positive financial habits through a saving and spending game and a goal-setting activity with real-life scenarios.

Overview

This lesson plan introduces the concept of financial goals and financial planning, using the tools of spending and saving. Advantages and disadvantages of both spending and saving, as well as when to use each, are explored. Students will take part in a class simulation to introduce concepts. Next, students will apply what they’ve learned by creating a savings plan based on the financial goals, resources and values of a fictional character.

Big idea

Many of us have short- and long-term financial goals. Planning for financial goals and using saving and spending strategies can help us achieve our goals as well as financial confidence and stability.

Total time

Approximately 120 minutes of instructional time, or 2 to 3 periods.

Grade level

Grade 5; Cycle 3

Subject areas

Math

- Addition and subtraction of decimals

- Math problems using money

Financial literacy

- Short- and long-term financial goals

- Saving and spending strategies

- Dealing with setbacks

Learning objectives

Students will:

- define and provide examples of short- and long-term financial goals

- define saving and spending

- create a savings plan to meet a financial goal

- explain how emergencies and external factors can disrupt savings plans

- explain the motivations, consequences and benefits of saving and spending choices

- add and subtract decimals.

Materials

Classroom supplies and technology

- printer and paper

- pens and pencils

- calculators

- projector or display screen hooked up to a computer (optional)

- board, chart paper or screen and markers

Handouts and worksheets

- Download the worksheets and answer key.

- Print the worksheets below. To save on paper or printing, some of these resources can be distributed digitally or displayed for the class.

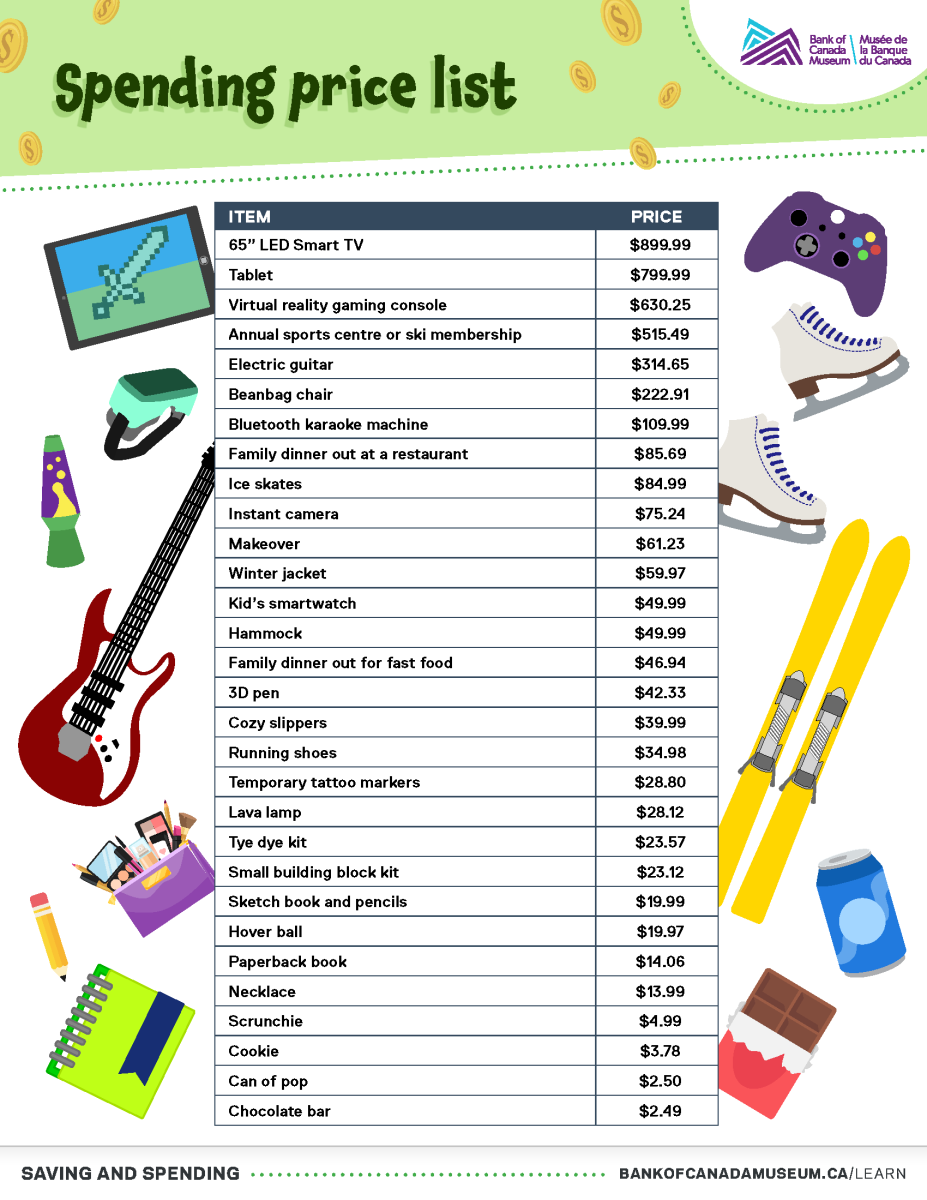

- Activity 2: “Spending price list” worksheet (one copy per group, or display) and “Track your spending” worksheet (one copy per group or per student)

- Activity 3: “Sample character profile” and “Sample savings plan” worksheets (display), “Character profiles” (one copy per student, or display), “Character profile” worksheet (one copy per student) and “Savings plan” worksheet (one copy per student)

- Download and print these resources (on cardstock if possible):

- Printable play money (optional)

Activity 1: Discussion of financial goals

Begin with a class discussion about goals, planning and setbacks, moving from familiar life goals to financial goals specifically.

Time

20 minutes

1.1 Introduction

Tell students you need their help! You have a goal (it can be anything you think is interesting or relevant) and you need their help to make a plan to achieve it. Be creative and energetic; have fun and capture your students’ attention. Here are some ideas:

- Welcome students to the classroom by playing the song “Smoke on the Water.” Tell them your goal is to learn how to play that famous opening riff, but you don’t even own a guitar. Have them brainstorm a few steps you could take towards achieving your goal.

- Welcome students to the classroom with some physical warm-up exercises. Tell them your goal is to run a 10K race next year. Ask them to help you come up with steps towards achieving your goal.

Ask students:

- What do you need to achieve a goal?

- all the necessary materials and support

- a plan

- What makes a good plan?

- breaks big goals up into smaller steps

- has steps that move from the easiest to achieve to the hardest

- has specific targets and deadlines to help keep you on track

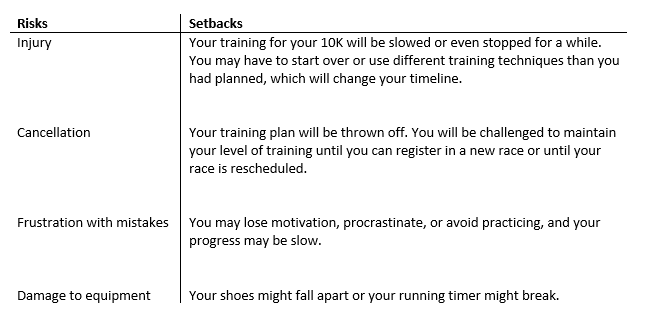

Explain to students that all plans have risks, and those risks can lead to setbacks. Setbacks occur when a goal is delayed or progress is reversed. Some risks are easier to predict than others. When setbacks happen, you may need to adjust your plan or even your goal, and that is okay. Setbacks happen to everyone.

Ask students: “What are some risks that could create setbacks for our goal?” Record their answers in a T chart on the board.

Risks and setbacks

- Injury: Your training for your 10K will be slowed or even stopped for a while. You may have to start over or use different training techniques than you had planned, which will change your timeline.

- Cancellation: Your training plan will be thrown off. You will be challenged to maintain your level of training until you can register in a new race or until your race is rescheduled.

- Frustration with mistakes: You may lose motivation, procrastinate, or avoid practicing, and your progress may be slow.

- Damage to equipment: Your shoes might fall apart or your running timer might break.

1.2 Financial goals

Explain that, in addition to other goals, many people have financial goals. Financial goals are the objectives we each set for managing our money. We all have different goals and different starting points.

Explain short- and long-term financial goals.

- Short-term goals are typically achieved in less than a year.

- Long-term goals will take multiple years to achieve.

Have students brainstorm some short-term and long-term financial goals that they think people might have (not necessarily their own personal ones). Write some down on the board, or have students share in small groups. Remind your students that not everyone will have these same goals.

1.3 Financial planning

Select one of the short-term goals from the brainstorming to use as an example. Discuss some possible steps someone could take to meet that goal and what some possible risks and setbacks.

Activity 2: Saving and spending simulation

This immersive simulation will allow students to experiment with different saving and spending strategies towards a goal. In this simulation, students have the financial goal of maximizing their purchases. In groups, students will try different strategies (saving, spending and a balance of the two) to see how these strategies affect how much and which items they are able to purchase.

Time

40 minutes

2.1 Hands-on activity

Students will play a simulation game with five rounds in which they will spend or save. The goal of this simulation is to compare three strategies for meeting financial goals: saving, spending, and a combination of the two. The financial goal in this game is to purchase items at a store.

- Display the “Spending price list” worksheet at the front of the class.

- Divide students into three groups (The Savers, The Spenders and The Balancers) (Note: The Savers have the least amount of math to do).

- There will be five rounds of play. Each group will be given the same amount of money for each round, but each group has different instructions for how to use it. You can use our “Printable play money” or any representation of cash. It is also possible to do this activity without cash, tracking the purchases on the sheets only.

- Students will use the “Track your spending and saving” worksheet to record their transactions (each student will use their own sheet to track the group’s choices, to practice adding and subtracting decimals and to verify each other’s answers).

- Round 1 – Each group is given $100 to start.

- The Savers will save all $100 in their savings bank. No purchases are made this round.

- The Balancers will save half ($50) in their savings bank and will spend as close to $50 as they can on items listed in the “Spending price list” worksheet.

- The Spenders may select anything they can afford from the “Spending price list” worksheet. Their job is to spend as close to $100 as possible.

- Students will record their group’s choices on their worksheets and complete the calculations. Students will make purchases using their cash (the teacher or a student volunteer will act as cashier) and ensure they receive the correct change.

- Once each group has finished, the next round will start.

- Round 2 – Each group is given $200 to start.

- The Savers will save all $200 in their savings bank (total $300). No purchases are made this round.

- The Balancers will save half ($100) in their savings bank (total $150) and will spend as close to $100 as they can on items in the “Spending price list” worksheet.

- The Spenders may select anything they can afford from the “Spending price list” worksheet. Their job is to spend as close to $200 as possible.

- Students will record their group’s choices on their worksheets and complete the calculations. Students will make purchases using their cash (the teacher or a student volunteer will act as cashier) and ensure they receive the correct change.

- Once each group has finished, the next round will start.

- Round 3 – Each group is given $300 for this round.

- SETBACK There’s an emergency! Their pet is sick, and they need $450 to pay the vet.

- The savers will use their $300 from this round and $150 from savings (total $150). No purchases are made this round.

- The balancers will use their $300 from this round and $150 from savings (total $0). They get to keep all their previous purchases. No purchases are made this round.

- The spenders will use their $300 from this round but since they have no savings, they will need to sell everything they previously purchased to make up the difference. They may complain that this isn’t fair since the value of those products was $300, but you can explain to them that the value of those items used is not the same as it was when they were new, and that you can typically sell a used item for only about 50% of its original price. No purchases are made this round.

- Students will record their payments on their worksheets.

- Once each group has paid for the vet, the next round will start.

- Round 4 – Each group is given $400 to start.

- The Savers will save all $400 in their savings bank (total $550). No purchases are made this round.

- The Balancers will save half ($200) in their savings bank (total $200) and will spend as close to $200 as they can on items in the “Spending price list” worksheet.

- The Spenders may select anything they can afford from the Spending price list. Their job is to spend as close to $400 as possible.

- Students will record their group’s choices on their worksheets and complete the calculations. Students will make purchases using their cash (the teacher or a student volunteer will act as cashier) and ensure they receive the correct change.

- Once each group has finished, the next round will start.

- Round 5 – Each group is given $500 for this round.

- Each group may spend all their money this round, including their savings. This is what they’ve been saving for!

- The Savers will spend as close to $1050 as possible. They will have enough to purchase any item on the list, including the most expensive.

- The Balancers will spend as close to $700 as possible. They will have enough for some expensive items but not the most expensive and they have some smaller items from previous rounds that they were able to buy sooner and keep.

- The Spenders will spend as close to $500 as possible. They do not have enough for the expensive items but will have lots of lower-priced items from round 4 and 5. The setback cost them the most, because they lost value on their purchases by having to resell them at half their original price, but they were able to have their items sooner.

To enhance learning, you could continue running the simulations in Activity 1 by substituting the emergency setback in round 3 with other real-world variables to help students understand the complexity and interconnectedness of personal finance and the broader society and economy, for example

- add mandatory bills that students have to pay each round

- give groups unpredictable and changing amounts of money each round to demonstrate the impact of income insecurity

- halfway through the game, double all the prices without increasing income to show the impact of inflation

- give different groups different amounts of money to start, and throughout the game, to show the impact of systemic discrimination (racism, intergenerational poverty, the gender pay gap, etc.)

2.3 Debrief

Discuss with the class their observations of each of the scenarios.

Review what each group was able to purchase using their specific spending/saving strategy and discuss their observations using the following questions.

- Which strategies were successful? What is successful to you?

- Were you happy with what you were able to purchase?

- Was there something you wanted that you weren’t able to get? Why?

- What were the benefits and downsides of each group’s strategy?

- Did the group you were assigned reflect the way you usually spend and save money?

- Will this activity change any of your future spending and saving choices?

- What kinds of things might impact the strategy a person might choose?

- The Savers saved until the last round and then spent it all, but what if you never spent anything in case of an emergency? Would that work? Why or why not?

- Who was worst impacted by setbacks?

- Is there an even better strategy?

Activity 3: Creating a plan

Now that we’ve explored goal-setting and saving and spending strategies, it’s time to make a plan. Each student will create their own savings plan that will support a fictional character’s financial goal.

Time

60 minutes

3.1 Character savings plan overview

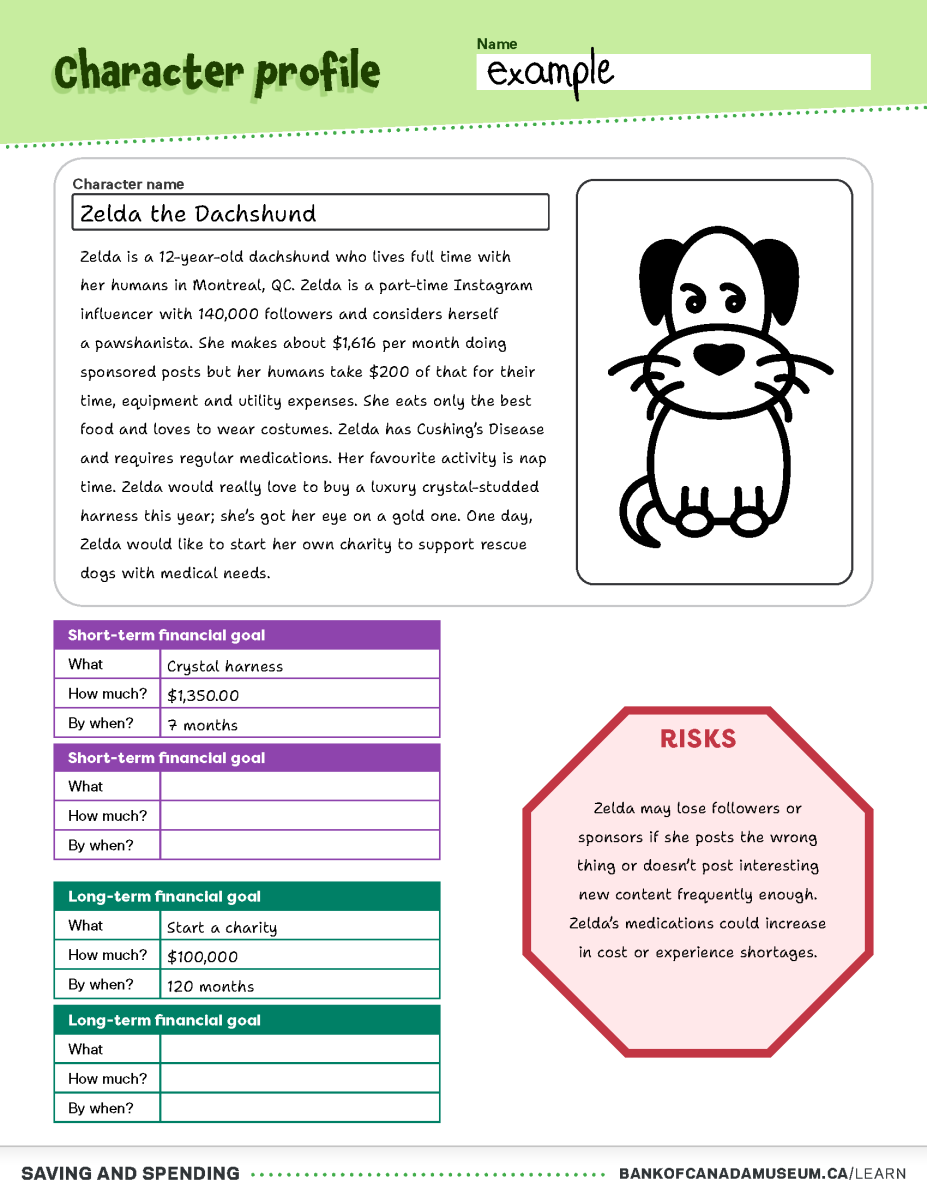

Each student will select a fictional character. They may use one of the “Sample characters” or create their own. Start by showing them an example character (Zelda) to explain how each part of the character profile and savings plan worksheet works. You may wish to display this information on a screen or distribute it via your virtual classroom.

Profile

Each character has a profile that explains a little bit about them, their situation, their interests, the ways they earn money and things they’d like to use their money for.

Goals

From this profile, determine their short- and long-term financial goals and research how much they cost. Zelda’s goals, for example, include purchasing a designer leash and starting a charity.

For example: Starting a charity is hard to estimate, but Zelda will need at least $100,000 in her own funds. Since this is a long-term goal, we can put the timeline at 10 years. The harness is easier; we can look up online what that type of harness might cost—in this case, $1,350. We know Zelda wants it this year, so this is a short-term goal of less than 12 months.

Income

Using the profile, what ways does the character have to earn money (e.g., working, allowance, chores, selling items)? This is called income.

For example: Zelda works as a part-time Instagram influencer, but she might be able to make more income if she did cross-platform posting. One way to reach a savings goal faster is to increase your income. Research how much your character might make each month with the ways they have to earn income. In Zelda’s example, she makes $1,616 monthly.

Expenses

Students will need to research reasonable costs of their character’s needs and wants for each month (e.g. buying lunch, social activities, other purchases). This is called expenses.

For example, we know Zelda likes expensive dog food. Zelda is a dachshund so we can find expensive dog food brand prices online to work out how much she would need to buy per month. We also know she likes costumes. If we estimate she gets a new one each month, that will cost approximately $20. A big part of Zelda’s life is that she has Cushing’s disease and needs to have regular medications. This will cost about $50 a month on average. Another way to reach a savings goal faster is to reduce expenses. Zelda could reduce her costume purchases to a new one every two months if she wanted to reach her goals faster.

Risks

What risks does your character face that may cause setbacks?

For example, Zelda is an influencer and influencers are always increasing or decreasing in popularity. She may grow in popularity today, but she could easily be bumped by the next cute dog tomorrow, or she could say the wrong thing in a post and lose followers. This risk could cause a setback to her goal by reducing her income. Zelda is also reliant on medications to stay healthy. These could increase in price. This risk could cause a setback to her goals by increasing her expenses.

3.2 Complete the “Character profile” worksheet

Display or hand out copies of the “Character profiles” worksheet. Students may use one of the four sample characters provided, or they may create their own. Note that the animal characters are simpler to complete than the human characters.

Students will complete the worksheet with the following steps:

- Choose or write a character profile, and include details about the character’s hobbies, interests, activities, goals and ways to make an income.

- Identify their character’s short- and long-term financial goals and specify how much the goals will cost and the timeline the characters have to meet them.

- Assess the risks to which their character is exposed that may lead to setbacks to their savings plan.

3.3 Create a savings plan

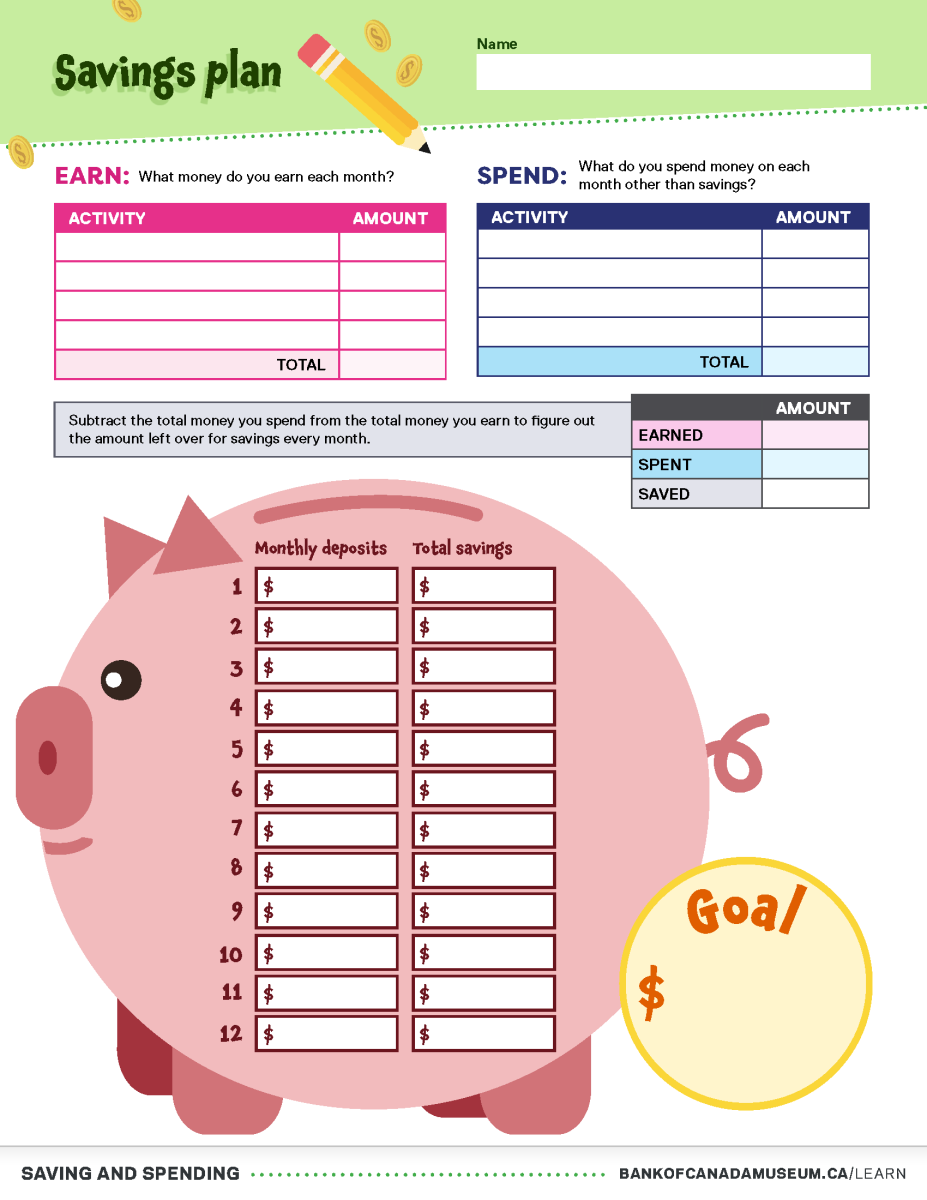

Students will select one of their character’s financial goals and complete the “Savings plan” worksheet. They can use a short- or long-term goal. You can display the “Sample savings plan” for the students to follow.

Savings available

Students will need to calculate how much their character will have available each month to put towards their savings plan. They must figure out how much of their character’s income is left for savings after subtracting all their expenses.

Plan

Finally, students will create a savings plan that will show how much their character will save each month, and how many months it will take them to reach their goal. In Zelda’s case, she’s able to reach her goal in two months if she’s not saving towards any other goals at the same time.

The following tips will help students complete this worksheet.

- Students can use a calculator for this part of the exercise. They will also need to do some research for accuracy (e.g., minimum wage in your province, average pay for a babysitter, cost of cat food, etc.)

- For each of the ways their character earns income, students will have to research and estimate, to 2 decimal places, how much income their character can make each month.

- For each of their character’s expenses, students will research and estimate to 2 decimal places how much it will cost per month.

- Students will subtract their characters’ expenses from their incomes to determine how much their character has available to save each month.

- Before moving ahead with the final savings plan, students should check in with or submit to the teacher their profile, goals and estimates to ensure these are reasonable.

- The point of this exercise is not to be perfectly realistic in their estimates. There’s no “right” answer. Students should think critically about how their character’s circumstances might affect their financial goals and savings plans, set clear financial goals, create a monthly savings plan and add and subtract decimals correctly.

- Students will complete a plan to show, by plotting their savings amounts in the chart, how much their character will save each month towards their goals and how long it will take to reach them.

Conclusion

Time

5 minutes

Ask a few student volunteers to share their savings plans with the class. To close the lesson and check for understanding, ask your students the following questions:

- Why is it important to set financial goals and to plan for them?

- Why doesn’t everyone have the same financial goals?

- What are some of the benefits and downsides to saving and spending?

- What are some of the kinds of risks to their savings plans your characters face? How are these similar to or different from what real people might face?

- What can be done when a plan is interrupted by a setback or emergency?

Key takeaways

- Different people have different financial goals.

- Financial goals can be short- or long-term.

- Income is the money that someone earns.

- An expense is a thing that someone spends money on and is either a need or a want.

- Setting clear, specific financial goals and creating a savings plan helps meet financial goals.

- Anticipating risks that can lead to savings setbacks is part of good financial planning.

- Saving and spending strategies are tools we can use to achieve financial goals.

- The choices we make about when to spend and when to save affect our financial goals.

Extensions

- Students can select an historical character. They will need to consider how their needs, wants and pricing may be very different from today. Check out the Bank of Canada's Inflation Calculator as a way to calculate costs.

- Students can create their own personal savings plan for their own financial goals.

- Encourage students to explore or journal their own personal values around saving and spending. What types of things might affect their own values about saving and spending?

- Look at the effects of saving for post-secondary education. Then discuss the article “Learning and earning” and explore the Financial Consumer Agency of Canada’s resources on funding post-secondary education.

- Living independently or buying a house is a common long-term goal. Review the Canada Mortgage and Housing Corporation’s Renting or Buying tool to determine which goals may be right for your character or for you.

- Goods and services change price over time and these changes will have big impacts on planning for future goals (especially long-term). Explore inflation with our video and discussion guide Inflation over time. How might inflation affect their savings plans?

- Students can plan an event on a budget with our budgeting lesson plan “Budgets: Math for life.”

- To take budgeting to the next level, try our intermediate level budgeting activity, Building Budgets.

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.