Introduce budgeting concepts and best practices by planning an event. Students will build skills with fractions, decimals and percentages using worksheets and hands-on activities.

Overview

Big idea

Budgets are a basic element of successful financial planning.

Total time

80 minutes of instruction; 60 minutes of independent work

Grade level

Grades 4 to 6; Elementary Cycle 2 to 3

Subject areas

Financial literacy

- financial planning

- how to make a budget, what it is and what it’s used for

- income and expenses

- how to calculate the balance of a budget

- budgets in everyday life

Math

- add and subtract decimals

- calculate percentages

- use fractions in everyday life

Learning objectives

Students will:

- define budgets and identify multiple scenarios in which budgets are used

- identify and define the five main sections of a budget: goals, time frame, income, expenses, and balance

- create balanced budgets

- add and subtract decimals, calculate unit cost, and divide money through percentage.

Materials

Classroom supplies and technology

- printer and paper

- pencils and erasers

- projector or display screen hooked up to a computer (optional)

Worksheets

Download and print these resources on regular paper (to save paper/printing, some of these resources may be displayed on a screen or distributed to digital classroom platforms for reference):

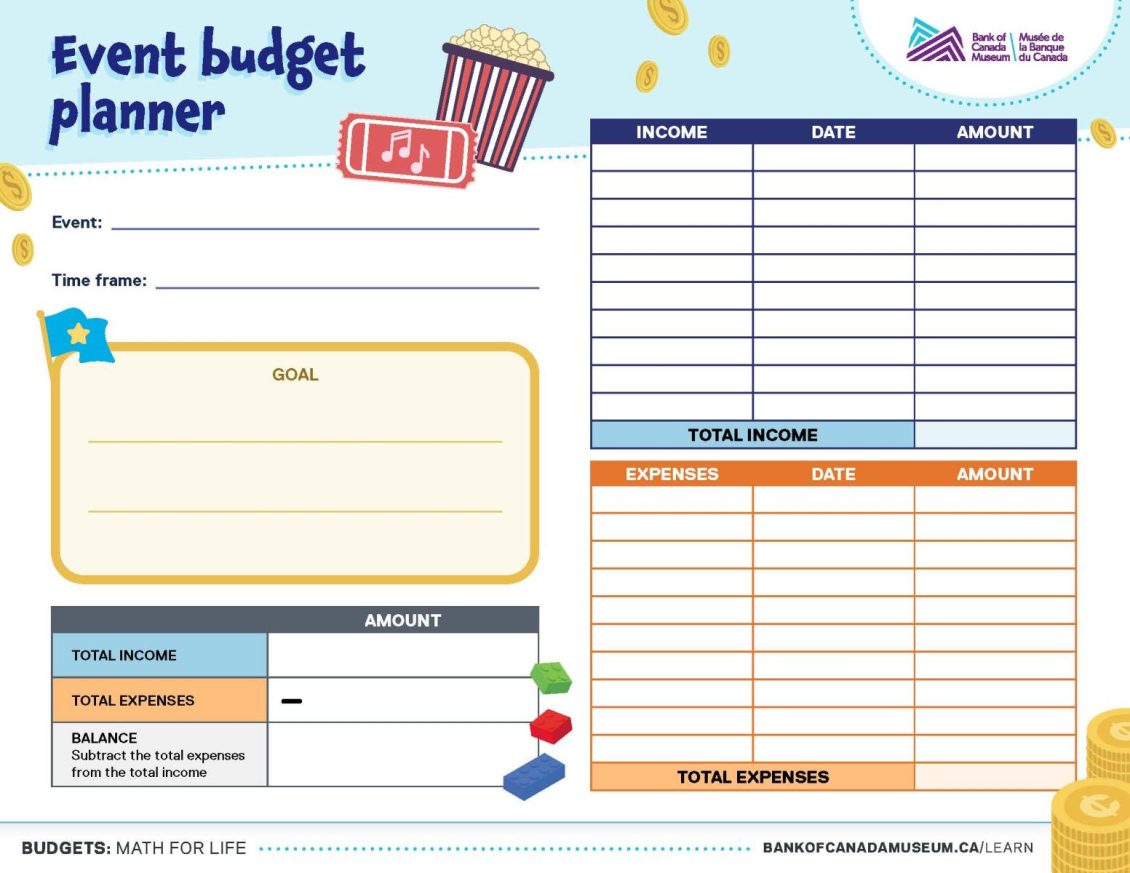

- Activity 1: “Budgeting tips for kids” and “Key terms” (print one copy per student or display /distribute digitally), “Event budget planner” (display a digital copy for the class, print for Activity 3).

- Activity 2: Worksheets “Adding and subtracting decimals”, “Calculate unit price,” “Sharing money equally” and “Calculate the balance” (one copy of each per student or group of 2–4 students. If you wish to distribute digitally, the PDF is a fillable form.)

- Activity 3: “Event budget planner” (one copy per student or group of 2–4 students)

Activity 1: What is a budget?

Introduce the concept of a budget as a plan; define key terms: budget, goal, time frame, income, expenses and balance.

Time

30 minutes

1.1 Opening discussion

Ask your students: If you were given $200 to have a class party, where would you start? After a few moments of discussion, explain that they will need to start with a plan. A plan for your money is called a budget.

Ask your students: Have they ever made a budget? What was it for?

- Explain that budgets are useful for all sorts of things. Brainstorm ideas about the sorts of things budgets can be used for, for example: to manage your own money

- to plan events

- to grow savings

- to buy groceries

- for families, businesses, organizations—even the Government of Canada has a budget.

Discuss with your students the value of budgets as a financial literacy and accountability tool by asking:

- Why are budgets important?

- If you were going to make a budget, what would you need to know? What would you need to include?

1.2 Example

Show students the “Budgeting tips for kids” infographic. You may also distribute this to their virtual classroom or print it for their reference.

- Discuss each of the tips with students. Ask: Which tips do you like best? Why?

- Which tips are the most important?

- Are there others you would add?

A budget is a plan for money. A budget shows how much money you earn (income) and how much you spend (expenses). Show or distribute “Key terms”. Together, review each of the five sections of a budget:

- goal: what you hope to achieve with your money

- time frame: the specific period of time covered by your budget

- income: money available or coming in

- expenses: costs to pay out

- balance: the difference between the money coming in and the costs paid out. Most budgets are zero-based budgets where the person making the budget plans for the balance to be zero.

Ask students to go back to the example you used at the beginning of the class. As a class, use the worksheet titled, “Event budget planner” to fill in the goal, time frame, income and expenses for your class party. The totals and balance sections will be discussed in the next part of the lesson.

For example:

- Goal: To have a reward party for the class. What kind of party? Will it have a theme?

- Time frame: Will the party be next week? Next month? Set a date.

- Income: The class has $200. Will that be enough? Are there other sources of income for the party?

- Expenses: What do you need for your party? Will there be food, decorations, or music? Research how much each will cost. (You won’t be able to calculate the total expenses until after Activity 2.)

- Balance: What income will be left over after the party’s expenses? (You won’t be able to calculate the balance until after Activity 2.)

Activity 2: Budgets are math for life

Students sometimes ask: “When are we ever going to need math in real life?” Making a budget is a good example of “real-life” math. Setting a budget requires students to understand some math concepts. Depending on your students’ grade level, you may wish to cover all, or only some, of these concepts, or review those already covered.

Time

45 minutes

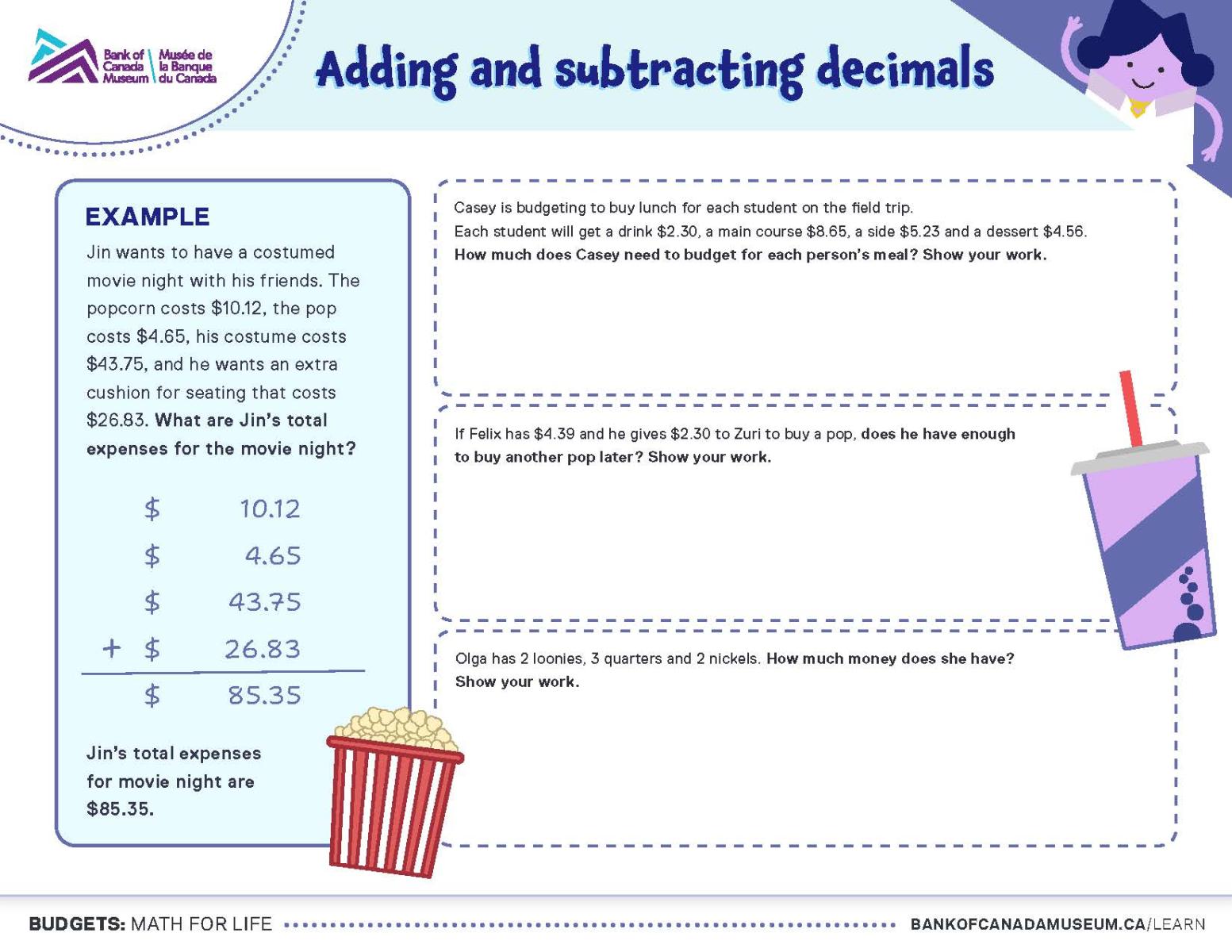

2.1 Worksheet: Adding and subtracting decimals

Explain to your students that adding and subtracting decimals are the main operations they will need to complete their budgets, because money is measured using decimals. Adding and subtracting decimals lets students calculate their totals and balance.

If this math concept is new for your students, demonstrate on the board with some sample numbers, using the method your class is familiar with.

Section 2 includes four worksheets where the students can practice adding and subtracting decimals, calculating unit price, sharing money equally and calculating balance.

Do the example question on the “Adding and subtracting decimals” worksheet together. Have students individually or in small groups answer Questions 1–3 to practice adding and subtracting decimals. Review the answers together or use the answer key to correct their work.

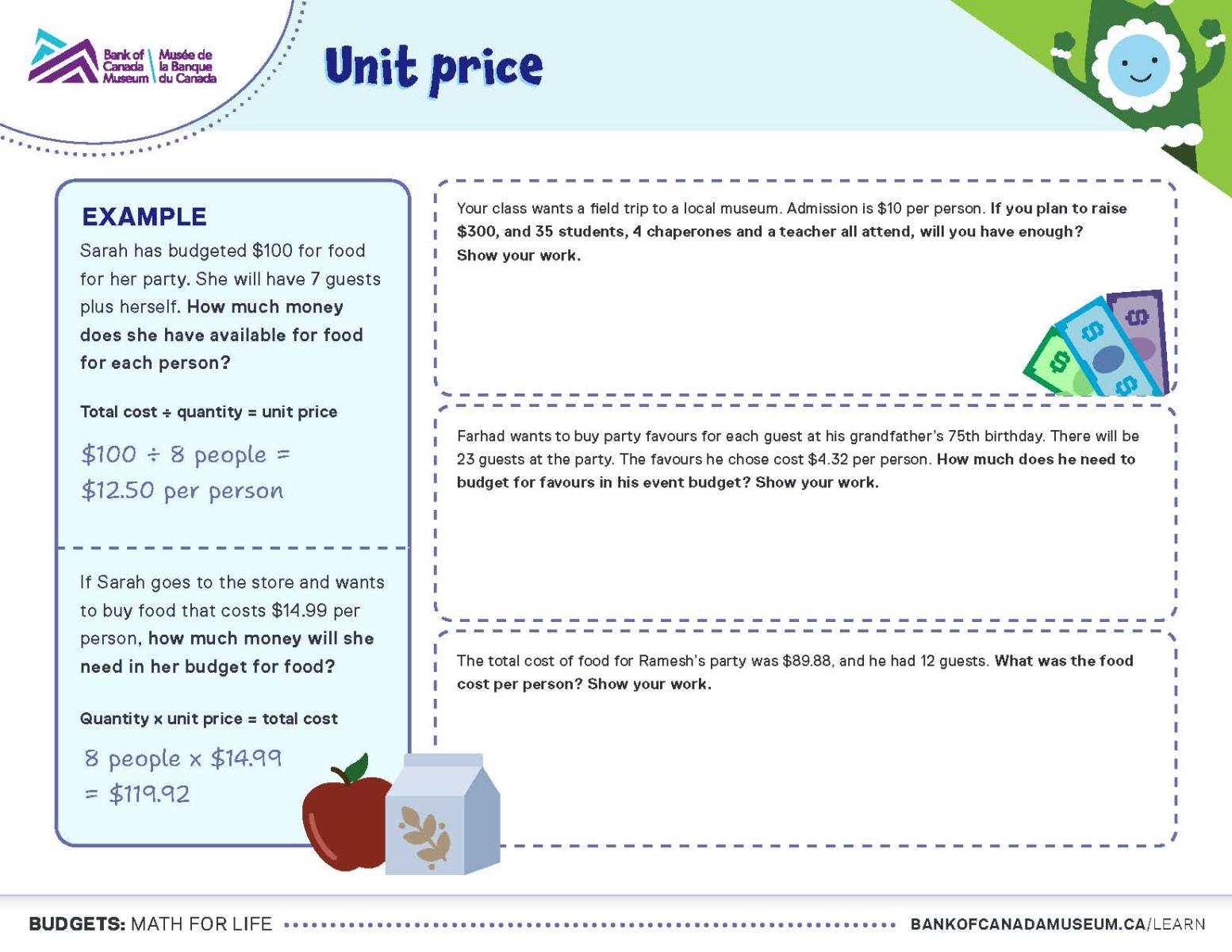

2.2 Worksheet: Calculating unit price

Explain to students that when they make a budget for a group event, they may need to find the unit price of items, that is, each guest’s cost.

Unit price is the cost of one item or one standard unit of measurement of an item.

To calculate unit price, divide the total cost by the quantity. You can also find the total cost of something by calculating the unit price multiplied by the quantity.

Do the example question on the “Calculating unit price” worksheet together. Have students (individually or in small groups) answer the remaining question. Review the answers together or use the answer key to correct their work.

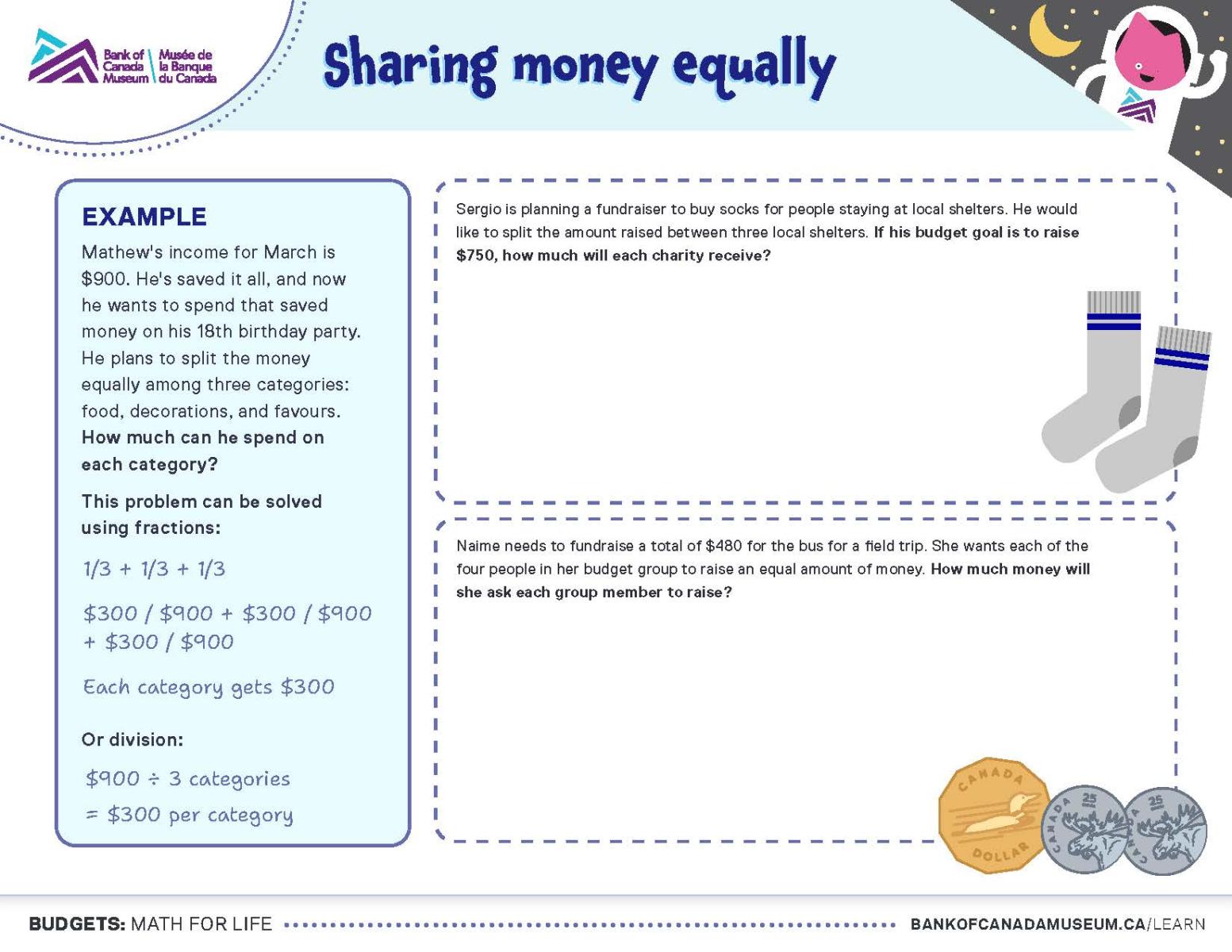

2.3 Worksheet: Sharing money equally

Explain to students that they may need to figure out how to share money evenly into parts when making budgets, e.g., share equal amounts of income among different expense categories.

To share money equally among categories, use fractions, or divide the total money by the number of categories.

Do the example question on the “Sharing money equally” worksheet together. Have students (individually or in small groups) answer the remaining question. Review the answers together or use the answer key to correct their work.

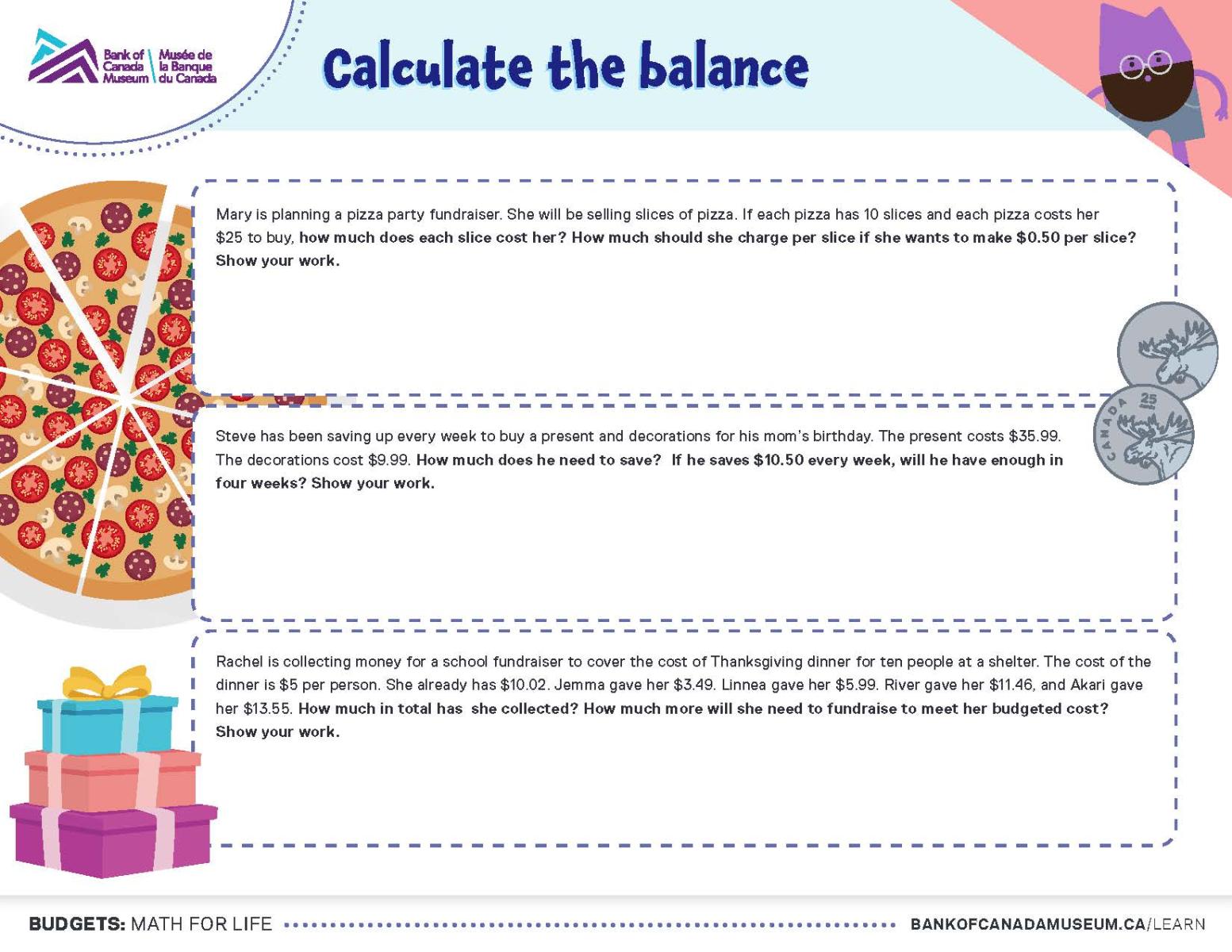

2.4 Worksheet: Calculate the balance

Have students individually or in small groups answer the questions on the “Calculate the balance” worksheet to practice real-world budget questions that combine the math skills they’ve learned. Review the answers together or use the answer key to correct their work.

Return to the “Event budget planner” worksheet and help the class calculate the totals for income and expenses and their final balance. Display the class example for students to reference while they work on their own event budgets in Activity 3.

Activity 3: Budget for your event

Students will follow the steps they’ve practiced as a class to create their own event budget, to apply budgeting skills to their own lives.

Time

60 minutes

3.1 Hands-on activity: Planning an event

In small groups, students will select an event from their own lives to budget for, or choose from one of these events:

- a birthday party

- an all-day educational field trip to a local museum, with lunch. The school’s parents council will provide $1,000; students will need to raise the remaining amount.

Students should brainstorm sources of income to pay for the event. Encourage them to be creative—could they ask for sponsorship? What kind of fundraiser could they hold?

Students should enter the event, the goal and the time frame into their own “Event budget planner” worksheet. Touch base with each group and make sure the event they’ve selected is a good example of how to use this math.

Students will need to research costs for the items they need for their event. They can use retail websites to get an estimation of costs. They will also need to discuss their needs versus their wants, and brainstorm and research possible sources of income to meet their needs.

Some expenses will be per person, while others will be shared. For example, students might want to buy one set of decorations for the whole party, but also need to plan how much food will be enough for each person. Remind students that the per-person costs need to be multiplied by the number of guests to find the total cost; consider giving them an example of how this works.

On the “Event budget planner”, students will calculate the income and expense totals and then their balance. Their balance must be zero or a positive number. If it is not, they will need to adjust either their income or expenses until their budget balances.

Conclusion

Time

5 minutes

To close the lesson and check for understanding, ask your students the following questions:

- What is a budget?

- What are the five main sections of a budget?

- What can we do to fix a budget that doesn’t balance?

- What kinds of things can we use a budget for?

- Why are budgets important?

Key takeaways

- A budget is a plan for our money.

- Budgets have five main sections: goal, time frame, income, expenses and balance.

- Math skills related to budgeting include adding and subtracting decimals, calculating unit price, and using fractions to divide money.

Extensions

- Check out the Grade 4 lesson Value for money: Determining unit price. Learn how to calculate a product’s unit price and total cost and determine if something is a real deal.

- Try the Grade 4 lesson Exploring payment methods. Learn about all the ways to pay for things and how to choose well among them.

- Brainstorm a list of events you have coming up this year. Which ones might benefit from a budget? Think especially about any that would need supplies, gifts or food, or ones you will need to save up for in advance. Can you make a budget for yourself for these events, or help your family come up with a budget for them? Try the Economics of Suppertime game to get started.

- Encourage students to ask their families about budgets. Do their families have budgets? What are their expenses? How might a person’s expenses change as they get older? How do their families make decisions about needs and wants?

- Review the “Budgeting tips for kids” infographic. Journal about which tip is most important to you and why.

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.