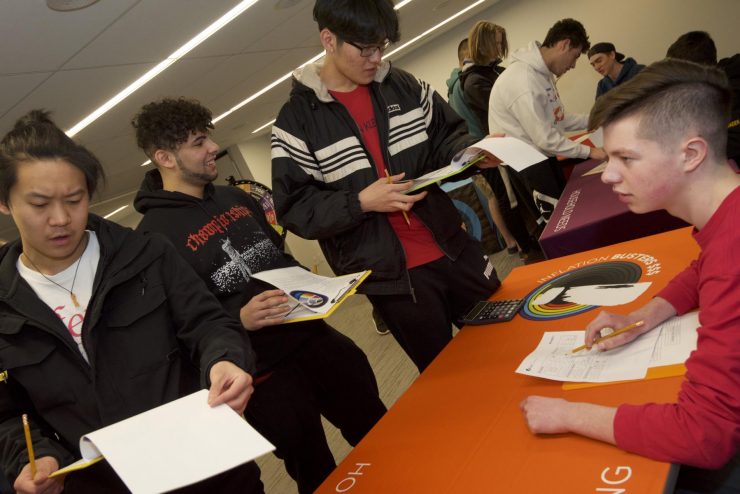

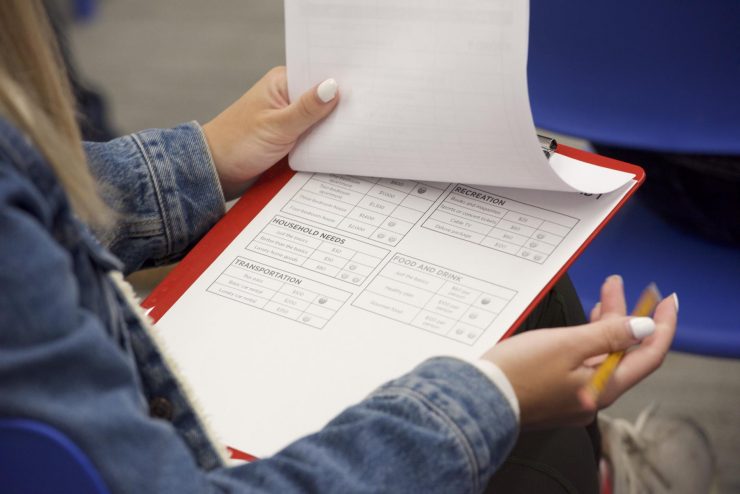

Develop a budget and navigate the economy in a time of high inflation in this game-based program that's offered onsite.

Students will see first-hand how difficult it is to plan when inflation rises. As goods become more expensive, students will look for ways to afford what they need. A great game to build financial skills while learning about the Bank’s critical role in keeping inflation low and stable.

Grades

Grades 9 to 12; Secondary Cycle Two and CEGEP

Big idea

Low and stable inflation allows everyone to plan for the future.

Learning objectives

Students will:

- compare the life of a consumer in times of both high inflation and low, stable inflation

- recognize the role of the Bank of Canada’s monetary policy in the financial choices and lives of consumers

- evaluate the importance of the economy and inflation in their lives

Curriculum links

Ontario

- Economics

- Grade 11: The individual and the economy

- Political and economic systems

- Financial planning

- Government intervention

- Grade 12: Analysing current economic issues

- The role of government in redressing imbalance

- Monetary policy

- Grade 12: Making personal economic choices

- Financial goals and financial planning

- Understanding the canadian economy

- Business Studies

- Grade 9 or 10: Introduction to business

- Economic basics

Quebec

- Secondary V: Financial Education

- Elements in drawing up a budget

- Why consumer habits may change

- Reasons for saving money

- The government and the economy

Duration

This onsite program runs for approximately 120 minutes. You’re welcome to book a 30 minute self-guided visit following your program.

Availability

This onsite program is offered Thursdays and Fridays. The last booking is at 15:00.

Cost

All school programs are offered free of charge.

Class size

25 to 50 students per program.

Book your visit

or call 613‑782‑8914 to book a visit. Please include the following information in your request:

- date and time of arrival

- number of students and teachers

- program or tour of your choice

- preferred official language

- any accessibility or special needs

We will confirm your booking within five to seven business days.

Before your visit

Try out the following activities:

- Delve deeper into the Consumer Price Index (CPI) and create a personalized CPI with the lesson plan Price Check: Inflation in Canada.

- Have a class discussion on inflation in Canada over time with the video Inflation Over Time.