Compare different payment methods, such as credit, debit and cash. This lesson plan uses a quiz, group work and scenarios to boost financial literacy.

Overview

Big idea

We can pay for things in many ways, but we should think critically about how we choose to pay.

Total time

60 to 75 minutes

Grade level

Grade 4

Subject areas

Financial literacy

- identify various methods of purchasing goods and services

- understand credit and debit cards and their differences

- make simple spending decisions

- demonstrate the ability to make responsible economic decisions

- access, gather, synthesize and provide relevant information about economic issues

Learning objectives

Students will:

- recognize the advantages and disadvantages of several payment methods

- determine the best payment method to use in a transaction

- understand the difference between debit and credit cards

Materials

Classroom supplies and technology

- pencils

- printer

- scissors

- white board and markers (or smartboard or projector)

Worksheets

- Download the activity and answer sheets.

- Print the worksheets below. To save on paper or printing, some of these resources can be distributed digitally or displayed for the class.

- Activity 1: “Payment methods infographic” (one copy for each student or display digitally) and “Payment methods” (one copy for every 2-4 students)

- Activity 2: “Payment scenarios” (one copy for the class, print on card stock if possible)

- Cut out the “Payment scenarios” cards.

Activity 1: Payment methods

In this activity, students will look at different payment methods and their advantages and disadvantages.

Time

30 minutes

1.1 Introduction

Discuss with the students how they pay for things:

- What was the last thing you bought? How did you pay?

- What other ways of paying have you seen adults use?

- Record student answers on the board.

- How do you think people decide how to pay each time they buy something?

1.2 Worksheet activity: Ways to pay

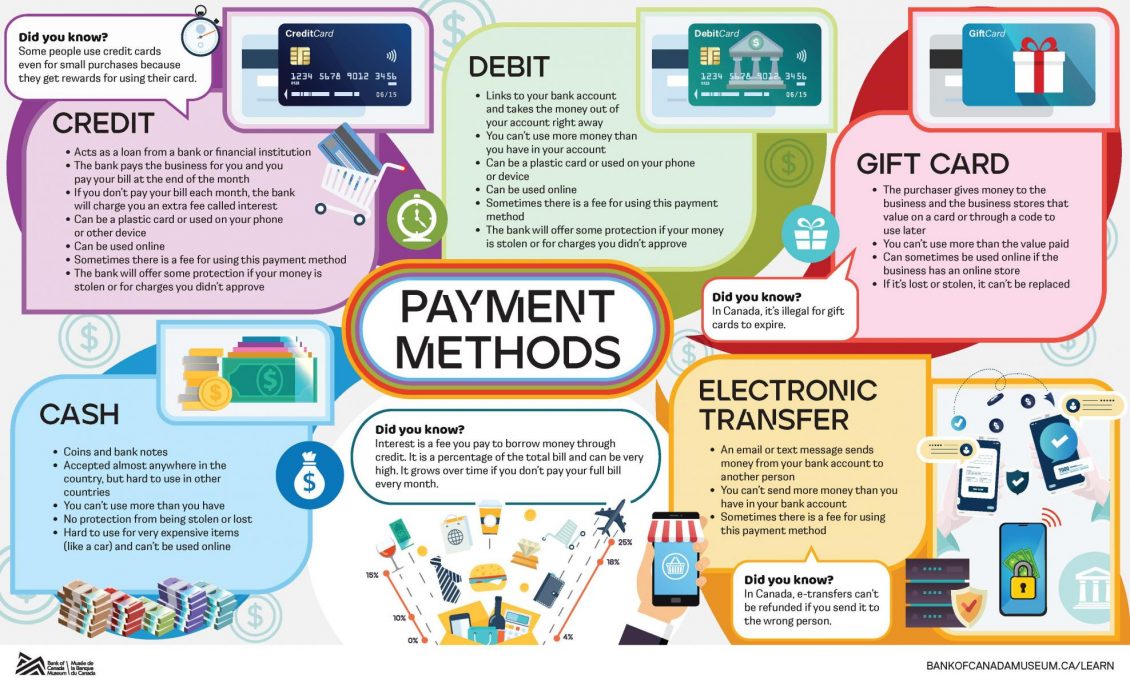

Display the “Payment methods” infographic on a projector or hand out copies to your students. If possible, ask students to share what they already know about each method.

Review the information together and summarize each payment method for the class.

- Cash is coins and bank notes that you carry in your wallet.

- Debit is a direct link to your bank account. It can be used through plastic debit cards or on your phone or other device. Money is transferred from your bank account to the store. Sometimes banks charge fees to use this card.

- Credit is a payment that acts as a loan from a bank. It can be used through plastic credit cards or on your phone or other device. The bank pays the store for you, and then you pay your credit card bill later. If you don’t pay your bill each month, it costs extra.

- E-transfer is short for electronic transfer. An email or text message sends money from your bank account directly to another person. Sometimes banks charge fees to send e-transfers.

- Gift cards are purchased from a business to use later. The purchaser gives money to the business, and they keep that value on a card or through a code for someone to use later.

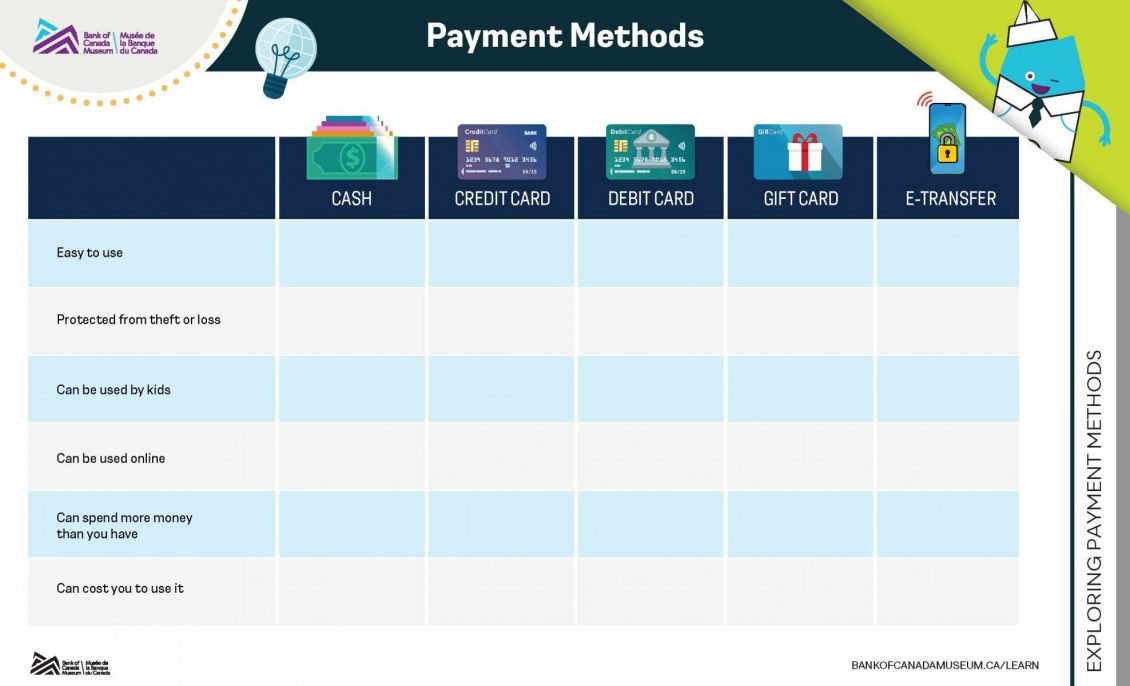

Put students in groups of two to four and give them a copy of the worksheet “Payment methods.” Students will look at all five ways to pay and identify which of the listed characteristics apply to each way.

Review and correct together.

Activity 2: Payment scenarios

In this activity, students will look at different purchasing scenarios and apply what they learned in Activity 1 to make decisions about which payment method to use.

Time

30 minutes

2.1 Introduction

Introduce the idea of decision making to your students.

Decisions can be difficult. In the case of payments, a lot of different factors go into deciding which payment method you might use. We have to make these decisions every day, but they get easier with practice.

Ask students:

- What are some things that you do to help you make any kind of a decision?

- The last time you paid for something, what were some of the factors in your decision about how to pay?

Ask students to think about what they learned about the advantages and disadvantages of payment methods. What are some of the factors they would consider when deciding how to pay for something?

Organize the students’ answers to the last question into categories on the board, following this example:

Availability

You only had cash

A gift card for a certain store

Amount

Cost too much to pay in cash

Too little to pay in credit

Acceptance

The café didn’t accept credit

Travelling with another currency

Can’t pay with cash online

Risk

Worried about protecting your money

Safeguards for paying online

2.2 Worksheet activity: Payment scenarios

This activity requires a maximum of eight groups. Divide students accordingly.

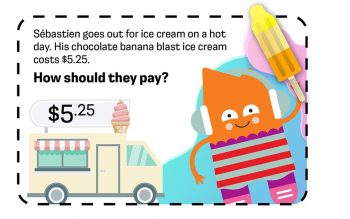

Hand each group one of the “Payment scenarios” cards. Ask students to discuss the scenario as a group and make notes of the factors in their decision.

How should they pay? Work together to determine the best payment method for each of these scenarios.

Ask each group to share their scenario with the class and their reasons for making their decision. There is more than one right answer for each scenario—the most important part is explaining their decision and the factors they considered.

Conclusion

Use the online quiz about the difference between credit and debit cards as a wrap-up activity to review these two important payment methods. Students could also complete this activity as homework.

Time

10 minutes

Key takeaways

- There are many payment methods, each with different advantages and disadvantages.

- You have to decide how to pay each time you buy something, and it’s important to look at all the factors when you make this decision.

Extensions

- Introduce the economic concepts of consumers, producers, goods, services and trade with our lesson plan Trade Rules—a fun, interactive trade game using cards.

- For more advanced information on payment methods, check out “How Canadians pay for things” from the Bank of Canada and “Payment options and money transfers” from the Financial Consumer Agency of Canada.

- Learn about making decisions about what to buy with our activity Needs or Wants? That is the question!

- Expand students’ understanding of decision making while grocery shopping with our activity The economics of suppertime—this also makes a great take-home activity!

We want to hear from you

Comment or suggestion? Fill out this form.

Questions? Send us an email.